We’re halfway through 2024, so it’s that time of year again; the Australian tax season is upon you.

Australia has a reasonable tax model, a unique tax administration system, and a rigorous tax audit mechanism. It is a country with a high welfare and tax burden. According to personal income tax, taxpayers must also pay a welfare insurance tax of 1.5 per cent of taxable income.

The statutory tax season in Australia is from 1 July to 31 October.

All tax residents in Australia must declare their income for the past financial year to the Australian Taxation Office (ATO) before 31 October to complete their tax return. If you wish to appoint an accountant to file your tax return, this can be extended to 31 March of the following year.

Who Needs to File a Tax Return?

Filing a tax return is the responsibility of every tax resident and is not the same thing as being a permanent resident or citizen of Australia.

According to the Australian Taxation Office (ATO), international students, holidaymakers and temporary visa holders are required to file tax returns if they meet any of the requirements of The resides test, The domicile test, The 183-day test and The Commonwealth superannuation fund test. For the superannuation fund test, you are an Australian tax resident.

Changes to ATO Tax Relief Application Methods

Australian Taxation Office assistant commissioner Tim Loh (pronounced Tim Loh) said there were now two methods of applying for tax refunds for working from home.

“We have the actual cost method and the fixed rate method. Under the actual cost method, you need to be able to separate private expenses from work-related expenses, and that method requires a lot of record keeping.”

Australian Taxation Office assistant commissioner Tim Rowe said the rules for claiming work-at-home expenses were in the process of changing.

Items that can be claimed for tax purposes under the accurate cost method are:

- Decrease in the value of depreciable assets – for example, home office furniture (desks, chairs) and furnishings, telephones and computers, laptops or similar equipment

- Electricity and gas for heating, cooling and lighting (i.e. energy costs)

- Home and mobile phone, data and internet costs

- Stationery and computer consumables such as printer ink and paper

- Cleaning costs for a dedicated home office

There is also a fixed-rate method of 67 Australian cents per hour: this means you claim 67 Australian cents per hour for each hour you work from home, and this calculation method doesn’t require you to separate your private and work-related expenses. However, this method restricts you from filing a separate tax return for each expense item. This method assumes that all your costs are calculated at this rate.

Previously, some refund agents had warned that the 67 Australian cents per hour refund calculation method could lead to lower refunds. However, Mr Rowe says it really depends on the facts of people’s situation, and it’s up to each individual to choose what method is more appropriate for them. In any case, he reminded taxpayers to keep good records.

Nearly nine million Australians claim work-related tax refunds worth about $22bn each year, many related to working from home. The average tax refund for the last financial year was about $2,500.

Car-related Travel Tax Refunds to Get ATO’s Attention

Mr Rowe said the ATO saw many people making mistakes with their work-related expense refunds. Car expenses are a massive tax rebate segment, including kilometres travelled, the purchase cost of the car (depreciation) and the fuel cost. Within the last financial year, tax refunds related to car expenses amounted to almost A$7 billion. Mr Rowe said, “We’re telling people that when it comes to car and driving costs, private use costs can’t be claimed as a tax rebate.”

Investors with Rental Properties in the ATO’s Sights Again

In 2021-22, 1.7 million individual investors claimed tax refunds, resulting in an average net rental yield of almost A$2,000, up from A$751 the year before. Mr Rowe said nine in 10 rental property investors would get their tax returns wrong. “We see people making many mistakes with interest deductions,” he said. “We see people refinancing their buy-to-let loans and then using the amount for personal expenses such as buying a Tesla or going on holiday with friends. And what we’re saying to people is that interest needs to be apportioned to private expenses.” People who do not declare their income from renting out their homes at places like Airbnb have also come under ATO scrutiny. “What we’re saying to people is: you know, you don’t usually have to pay capital gains tax (CAGT) on the sale of your owner-occupied property, but you do have to pay CAGT on the sale of your owner-occupied home if you’ve rented out a room and then sell it again.”

According to the report, the Australian Taxation Office only started processing tax refunds on 12 July. Tax agents are urging people not to return their taxes too early, which could increase the likelihood of mistakes.

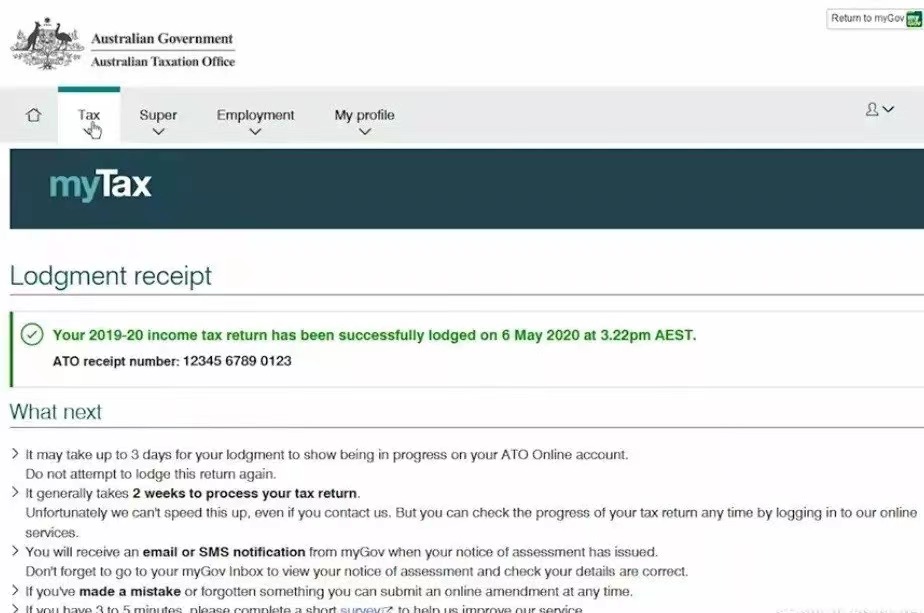

Australian Online Self-service Tax Return Tutorial

My Tax, The Australian Taxation Office ATO, has officially opened a particular tax filing channel for your convenience:

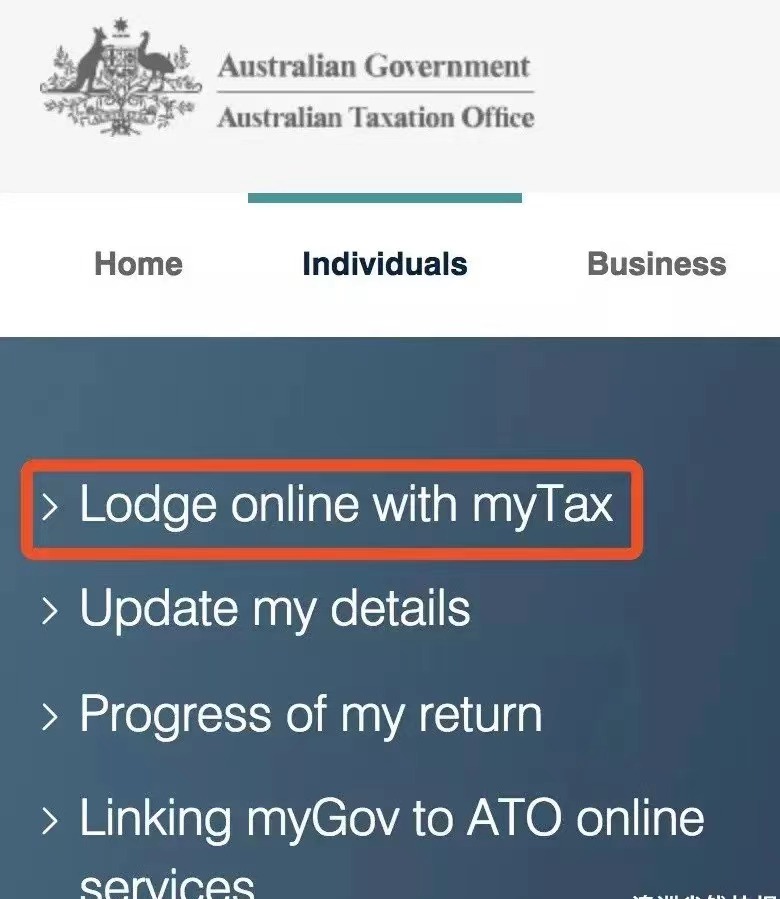

You can do this by logging into the ATO official website >>>> → Individuals → Lodge online with myTax

Or use the ATO app, and you can happily file your tax return!

Register for a MyGov Account

To use online tax filing, you need a myGov account, so you have to register on the ATO website. You can enter your registration name and password to log in if you’re already registered.

To register, you need to enter a valid email address, and you will receive a confirmation code. Then, it is simple to set up your account. Once you have registered and logged in, click on Link Your Services.

Select the Australian Taxation Office

Follow the instructions and fill in the information. You will also be asked to fill in your bank, pension, and notice of assessment to confirm that you are the person you say you are.

The following information is required to apply for an ATO account

- Bank BSB number, account number, account name

- Superannuation company ABN, superannuation superannuation account.

- If you had a tax refund last year, you will receive a notice of assessment (please ensure you keep it!). Please prepare this certificate as well.

- If this is your first time filing a tax return without a Notice of Assessment, the ATO will ask you to provide some information that only you know, such as the annual pre-tax salary on the PAYG summary.

- If you have a spouse (including a common-law partner), you may also need to enter each other’s information.

Entering MyTax to Start Filing

When logging into MyTax’s system, you will be presented with short questions. These questions will ask you about your income for the financial period.

Once you’ve entered the ATO service, click on ‘Lodge my Tax’, and after you’ve done so, you’ll see a total of four steps:

1. Fill in the basic information

The main purpose is to enter or update your address, phone number, email address, etc., in Australia.

2. Fill in the tax refund bank account number

Be sure to check the BSB and Account Number! Otherwise, the tax refund will go to someone else’s account!

3. Declare income and deduction amount

After ticking these boxes, you will normally see a list of incomes and a form to declare the deduction amount. If your employer hasn’t uploaded your income section, you can also enter it yourself according to the Pay Slip or ask your employer to upload it as soon as possible.

Note: If you are working for more than one employer, you will need to enter all of your earnings, and you will see the Payment Summary for each employer.

In the Payment summary, there will be an option of “Super lump sum” pension, if you are not leaving Australia permanently, don’t choose it!

Then you will come to the tax relief module which you are looking forward to, as long as it is related to your work/business, you can reduce it!

Under the current rules, supporting evidence is not required for expenses less than AED 300, and bank interest is also deductible!

4. Check the information and confirm

The final amount of tax to be paid will be displayed once the filing is complete.

Finally, you must wait for the review, which takes about 2 weeks.

Time to File Tax Returns

After 1 July each year, tax returns for the previous year’s tax expenditures begin to be filed.

- Individual tax return: 1 July to 31 October

- Appointed accountant to file tax return: 1 July to 31 March of the following year

Conclusion

If you have no previous experience in filing tax returns, it is best to get help from an accountant to avoid unnecessary trouble! Of course, if you already know the process well, you can do it yourself! However, if you encounter problems, always remember to consult a professional!

Book Student Accommodation in Australia

If you want to study in Australia and renting an apartment is a big problem, uhomes.com offers a huge range of affordable and comfortable student accommodation for Australian students at the cheapest student flat rentals! You can rent luxury or budget suites, studio flats, and private and shared rooms with various amenities at student accommodations in Melbourne, Sydney, Adelaide, Canberra, and Brisbane.

FAQ

What is ATO tax relief?

ATO tax relief refers to various measures and concessions provided by the Australian Taxation Office to assist taxpayers in reducing their tax liabilities legally.

How can I apply for ATO tax relief?

Applications for ATO tax relief involve completing specific forms or providing necessary documentation through the ATO’s online services portal. For precise instructions, consult the ATO website or contact a tax professional.

What documents do I need to apply for ATO tax relief?

The required documents may vary but typically include financial statements, proof of income, receipts for deductible expenses, and other relevant financial records. Accurate and thorough documentation is crucial for successful applications.