Finance has recently attracted much attention as a popular major for international students. When choosing to study finance, it is not enough just to learn the relevant knowledge. Passing the CFA test exam and getting a CFA certificate will pave the way for a career path. With this certificate, you can convince others of your professionalism in finance and add points to your ability.

If you are looking for a house rent in USA, uhomes is a good choice for you to choose apartment to live in New York, Los Angeles, Chicago, San Fransisco. There are different types of house for you to rent, and you can fill in a form. There will our consultant contact with you soon.

What is CFA Test Exam?

Chartered Financial Analyst, the CFA designation has been offered in more than 100 countries for over 70 years. Serving financial industries around the world, CFA has been establishing and advocating adherence to the highest industry standards throughout the region.

CFA is a professional qualification for the securities investment and management community. It is recognized by employers in more than 170 countries worldwide. The CFA is not a required legal qualification and it is possible to work in financial analysis without the CFA. However, having a CFA can add to one’s personal capabilities.

CFA are usually employed by investment firms, mutual benefit companies, securities firms, and investment banks. Or become a private wealth manager. According to the CFA Institute statistics: in Europe and the United States, the CFA title people’s salaries are generally 20% higher than their peers.

Even non-finance majors are sure to have heard of CFA. Because the CFA exam does not require that you have to be a finance major. So whether it is a finance major or a non-finance major, as long as you meet the requirements can be examined.

Requirements for CFA test exam candidates

Individuals wishing to take the CFA exam and register for Level I for the first time. must have an international travel passport. In addition, one of the following conditions must be met:

- Have earned a bachelor’s degree (or equivalent) or be in the final year of a bachelor’s degree program.

- Have accumulated 4,000 hours (approximately two years if you are working full-time) of applicable professional work experience. The experiences does not need to be related to financial investments.

CFA Text Exam Content

The CFA exam is divided into three levels: Level I, II and III. You can only take the next level if you have passed the previous one. That is to say that each year can only apply for a stage of the examination.

The first level of the examination is held three times a year in May, August and November. If you feel you don’t have enough time, you can choose the December exam. The second level is also held three times a year in May, August and November. And third level exams are held once a year in August at the same time.

CFA Test Exam Level 1

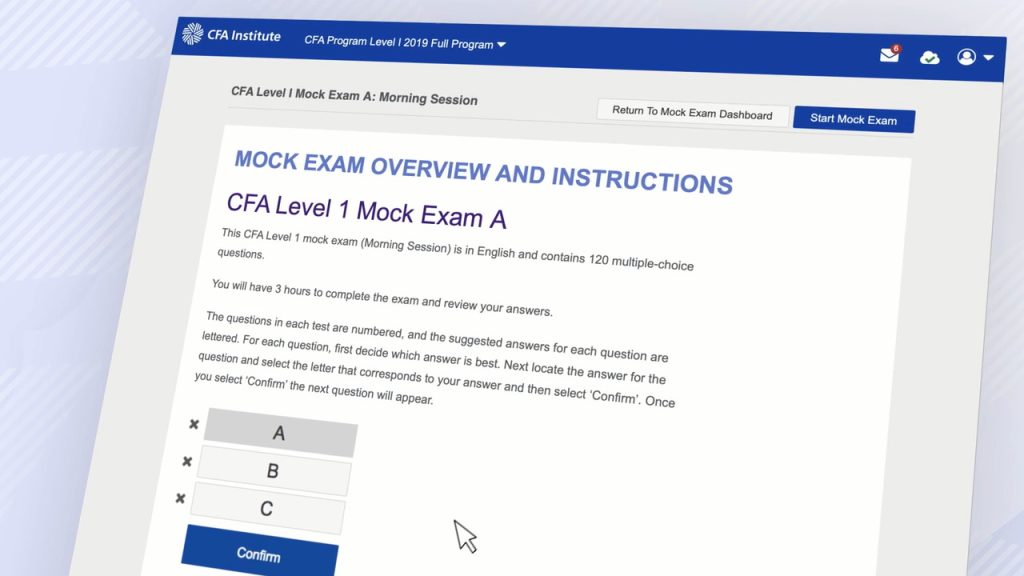

CFA Level 1 focuses on a variety of financial products and related basic knowledge. The topics cover a wide range of topics with a shallow depth of content, all of which are simple and straightforward. The aim is to give candidates a broad understanding of multiple areas of finance. Each test is mostly for understanding and memorization.

| Test Content | Proportion(Exam Weight) |

|---|---|

| Ethical and Professional Standards | 15% |

| Quantitative Methods | 10% |

| Economics | 10% |

| Financial Reporting and Analysis | 15% |

| Corporate Finance | 10% |

| Portfolio Management and Wealth Management | 6% |

| Equity Investments | 11% |

| Fixed Income | 11% |

| Derivative Investments | 6% |

| Alternative Investments | 6% |

Question Format:Multiple choice questions

Exam Result:Within 5-7 weeks of taking the exam and completion of your Practical Skills Module

Pass Rate:41%

CFA level 1 test dates 2024:

15-21 May, 20-26 August, 13-18 November

CFA Text Exam Level 2

Based on Level 1, CFA Level 2 focuses on the application and analysis of significant financial products. The main focus is on the valuation of financial assets. The exam’s content is similar, only the percentage has slightly changed, and the exam format has also changed.

| Test Content | Proportion(Exam Weight) |

|---|---|

| Ethical and Professional Standards | 10%-15% |

| Quantitative Methods | 5%-10% |

| Economics | 5%-10% |

| Financial Reporting and Analysis | 10%-15% |

| Corporate Finance | 5%-10% |

| Equity | 10%-15% |

| Fixed Income | 10%-15% |

| Derivatives | 5%-10% |

| Alternative Investments | 5%-10% |

| Portfolio Management and Wealth Management | 5%-15% |

Question Format:Vignette-supported multiple choice questions

Exam Result:Within 5-7 weeks of taking the exam and completion of your Practical Skills Module

Pass Rate:45%

CFA level 2 test dates 2024:

22-26 May, 27-31 August, 20-24 November

CFA Test Exam Level 3

CFA Level 3 exam focuses on portfolio and asset management. It focusing on the comprehensive application of knowledge and overall assessment. Looked at the proportion also know, portfolio management and wealth management this piece accounted for 40%.

| Test Content | Proportion(Exam Weight) |

|---|---|

| Ethical and Professional Standards | 10%-15% |

| Quantitative Methods | N/A |

| Economics | 5%-10% |

| Financial Reporting & Analysis | N/A |

| Corporate Finance | N/A |

| Equity | 10%-15% |

| Fixed Income | 15%-20% |

| Derivatives | 5%-10% |

| Alternative Investment | 5%-10% |

| Portfolio Management and Wealth Management | 35%-40% |

Question Format:Vignette-supported essay questions and vignette-supported multiple choice questions

Exam Result:Within 6-8 weeks of taking the exam

Pass Rate:52%

CFA level 3 test dates 2024:

16-19 August

CFA Test Price

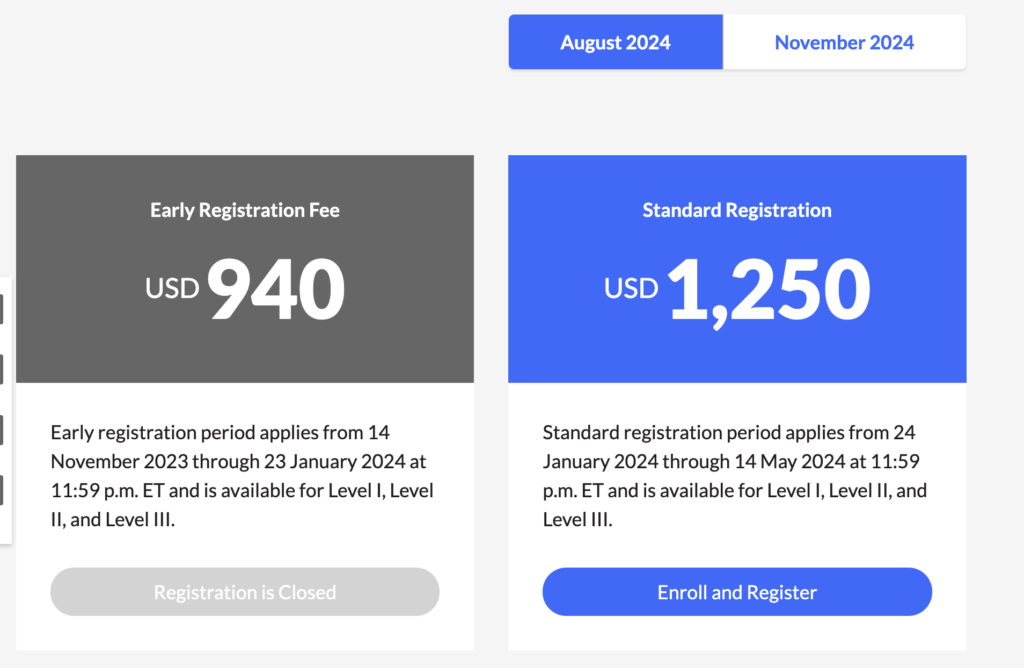

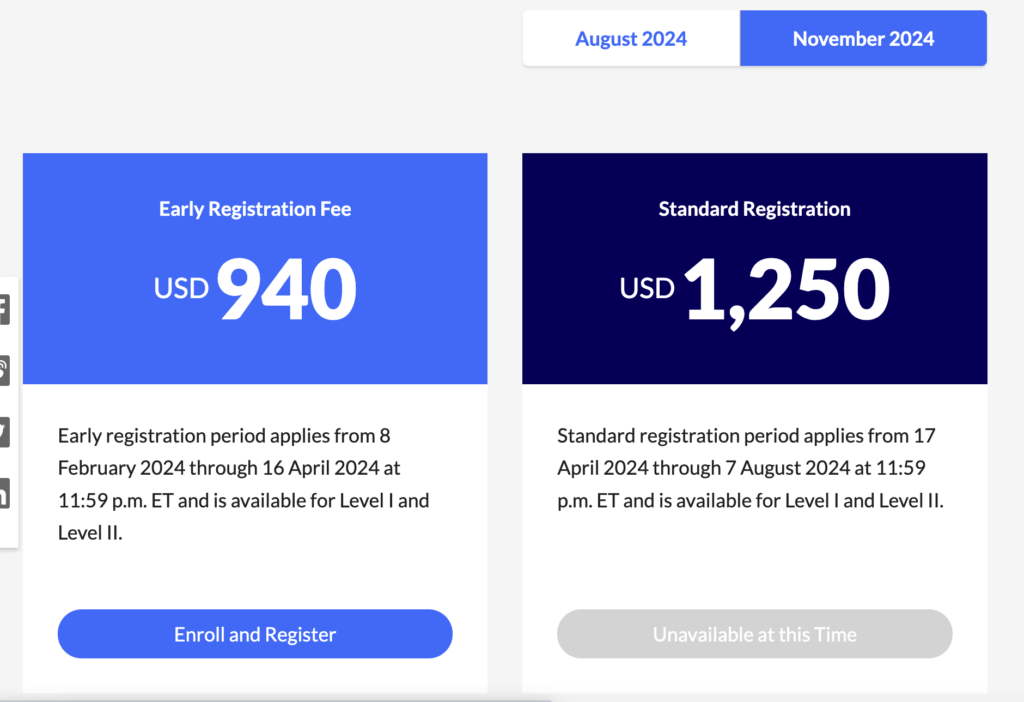

Taking the CFA exam begins with a one-time CFA registration fee of $350. In addition, you must pay the exam fee each time you register to take the exam. The CFA Institute has set, standard and later registration deadlines, and fees vary between standard and later time registrations.

The Early Registration Fee (ERF) is $940;

If you register before the standard deadline (Standard Registration Fee), you will have to pay $1,250.

CFA Test Exam Process

- Register on the CFA Institute’s official website

- Pay for the exam at the time of your choice.

- CFA test exam prep

- Take the exam

- Wait for the results to be announced

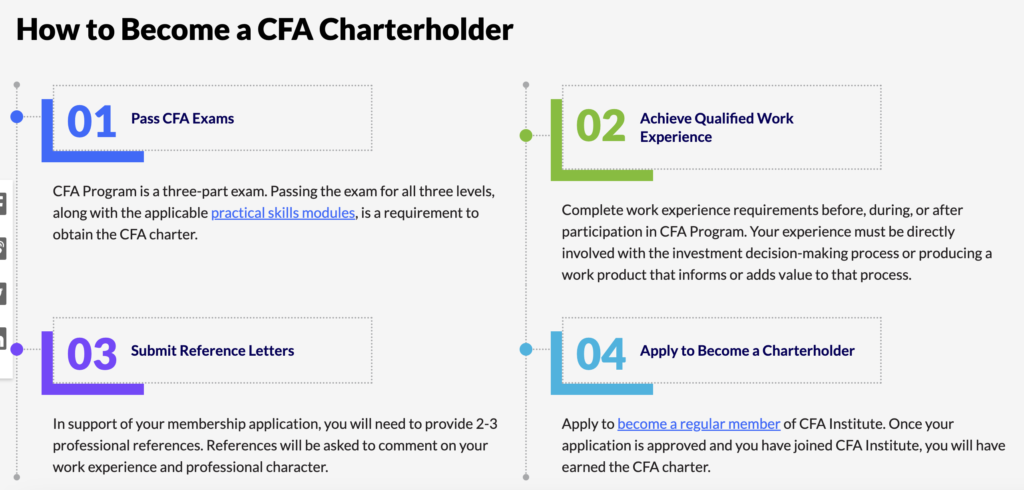

- After the examination of the third level + full 48 months and investment-related work experience + letters of recommendation, you can apply to become a CFA Charterholder.

Who is CFA suitable to take the exam?

The CFA focuses on investment analysis. And is suitable for jobs that require analysis or research on financial products/assets. It is highly recommended that students start registering for the level 1 exam. The year that they graduate from undergraduate school, mainly for the following reasons:

- Level 1 is a more comprehensive and integrated introduction to various financial fields. And it is very suitable for the starting.

- It takes two and a half years to complete the CFA Level 3 exam at the earliest. So you can start preparing for it as early as possible.

- For finance majors, a lot of Level 1 knowledge has actually been learned in the classroom, so it’s easy to get started. For non-finance majors, level 1 can help you get started quickly and learn the financial field systematically as early as possible, which is very helpful for changing majors.

Can I postpone the CFA exam after registration?

You can postpone the CFA exam only after registering under certain circumstances (mainly related to medical reasons). If you want a refund, it will not be given provided that the refund is made within three days of registration. If you pay the fee and do not go to the exam. You will have to register and pay the fee again the next time you want to take the exam. Before registering for the exam, make sure you are available.

- If you have a full-time job, review your weekly schedule before registering. And consider what time you can realistically set aside to prepare for the exam. If the exam is no more than six months away, consider taking it at a later date.

- If you are still attending university, consider making arrangements for competitive study or other priorities (such as an internship or job search) before registering.

Yes, the CFA test exam is widely considered challenging due to its comprehensive coverage of financial topics and rigorous testing format. Success typically requires extensive preparation, dedication, and a strong understanding of complex financial concepts.

The CFA test exam tests candidates on their knowledge and understanding of a broad range of investment and financial management topics, including ethics, economics, financial reporting and analysis, portfolio management, and more.

Six months can be sufficient for preparing for the CFA Level 3 exam, especially if you have a strong foundation in the relevant material and dedicate significant time to studying.

The cost of the CFA test exam program varies depending on the level of the exam and when you register. The registration fees for each level ranged from $700 to $1,450 USD, not including additional costs for study materials and exam registration.

No, the CFA test exam is not entirely multiple-choice. While the Level 1 exam consists entirely of multiple-choice questions, Levels 2 and 3 incorporate item set questions, which require more in-depth analysis and written responses.

Car Insurances Companies in USA: Securing Your Journey

When you buy a car in the United States, you can't help…

Comprehensive Guide for Your Motorcycle License USA

Many students knows that getting your motorcycle license USA is a necessity.…

Explore the Best Study Experiences in NYC

New York, as the biggest and famous cities in the United States.…