How much is the cost of living in Canada? If you are considering studying in Canada or moving there, the life expenses in Canada is a vital part in the plan of your budget and lifestyle. From the aspects of housing and groceries to transportation and healthcare, this blog will break down the expenditure in different parts. Whether you’re going to bustling Toronto, scenic Vancouver, or quieter cities like Halifax, this guide is quite clear to show the daily living expenses in Canada for 2025.

What is the Cost of Living in Canada?

Whether you study or try to start your life in a new country, the living expenses is definitely vital. The main aspects of life expenses in Canada include the expenses on accommodation, food and dining, transportation, other utilities (electricity, cooling, water, heating, garbage, Internet) , health care, entertainment. The average cost of living in Canada depends on the specific city, the area of the city, and the life style you choose.

Average Cost of Living in Canada for International Students

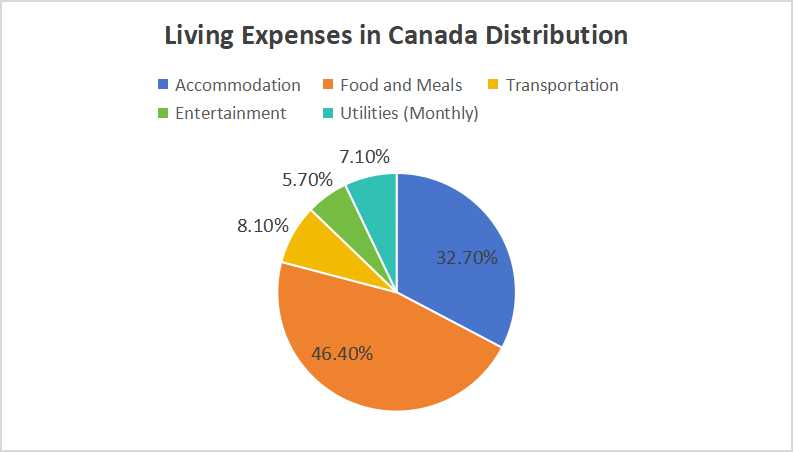

The average monthly expenditure in Canada varies because of the city, lifestyle, and personal habits that you choose. For students especially international students, Canada offers indeed a wonderful cultural and academic experience, but you are required to prepare for the costs associated with studying abroad. Big cities like Toronto and Vancouver tend to be more expensive for you. However, smaller cities such as Winnipeg or Halifax are much more budget-friendly. Some tips like shared housing, public transit, and student discounts can help to manage your expenses most effectively in order that you can enjoy your life in Canada. This is a table for the percentages of each part of life expenses in Canada for international students.

Detailed Cost of Living in Canada for International Students

The monthly expenses in Canada for students are $2,500 to $3,000 on average. This mostly covers the rent, food, transportation, and other essentials. To help you better manage your finances, you would better know these costs clearly. There is a table to show the detailed monthly costs.

| Cost of Living in Canada (Monthly) | |

|---|---|

| Category | Cost (USD) |

| Accommodation | $1,179–$1,345 |

| Food and Meals | $657–$1,095 |

| Transportation | $76–$114 |

| Entertainment | $219 |

| Utilities | $260 |

| Health Care | $36-146$ |

Life Expenses in Canada for Families

How much does it cost to move to Canada? If you and your family want to find a city in Canada and live there, the major parts of costs in Canada is occupied by the rent or housing charge. The prices of house vary significantly with the cities. There are other important life expenses such as groceries, childcare or school fees, transportation, utilities, and health insurance.

Groceries usually need around $600 to $900 per month. Childcare can cost $600 to $1,500 per child, unless the public schooling is used. Transportation costs are different because of different traveling ways, but they are generally $150 to $300 per month, whether through public transportation or personal vehicles. Utilities and internet typically cost around $110 to $220 per month. Families usually need to pay private insurance for dental, vision, or prescription, of which the coverage is not included in public healthcare. However, government support such as the Canada Child Benefit (CCB) and provincial assistance programs will help you reduce the financial burden.

- For a family of four, the estimated monthly costs are 3,820.2$ (5,233.4C$), excluding rent.

- For a family of two, the estimated monthly costs are about 1,822.51$ (2,500C$), excluding rent.

- For a single person, the estimated monthly costs are 1,065.2$ (1,459.3C$), excluding rent.

The prices of house vary significantly with the cities. Toronto and Vancouver are the most expensive cities, while Winnipeg, Halifax, and Quebec City are more affordable to live.

Income & Taxes: Balancing Your Budget in 2025

Most international students in Canada work part-time to cover their daily spending. The good news is that wages in Canada are decent, and the tax system is surprisingly friendly to students. Here is the reality of working and filing taxes as a newcomer.

1. What You Can Earn (The 24-Hour Rule)

As an international student, your study permit likely allows you to work off-campus. As of late 2024, the rule settled at 24 hours per week during school terms and full-time during breaks.

So, how much will that actually bring in?

Minimum wages have been ticking up to match inflation. In 2025, you can generally expect to earn between $15.50 and $17.50 CAD per hour for entry-level jobs (like barista, retail, or campus admin roles).

Here is a quick snapshot of what a typical part-time income looks like in major student hubs:

| Location | Min. Wage (Est. 2025) | Monthly Income (approx. 20hrs/week) |

|---|---|---|

| Toronto (Ontario) | ~$17.20+ | ~$1,376 |

| Vancouver (B.C.) | ~$17.40+ | ~$1,392 |

| Montreal (Quebec) | ~$15.75+ | ~$1,260 |

| Halifax (Nova Scotia) | ~$15.50+ | ~$1,240 |

Cost of Living in Canada : Accommodation

The biggest expenses is accommodation for most students and newcomers. Rent costs would be different with the different choice of cities and housing types. In bigger cities such as Toronto and Vancouver, a 1b apartment costs $880 to $1,480 per month. In more affordable cities such as Winnipeg and Halifax, the shared housing prices may be only $370 to $590. Basic utilities or internet are typically not included in rentals. This would be an extra money between $75 and $150 monthly. In order to save money, many students will choose shared apartments or on-campus housing.

If you are a student who is about to study in Canada, such as University of Toronto, Memorial University of British Columbia, and York University. before you leave for your favored destination, you may have to find a student housing there. It can be easy as you choose us uhomes.com for our services such as 1-on-1 professional support, verified listings, price-match guarantee, and exclusive offers. You can get a nice house here to enjoy your college life!

Average Rentals in Canada for International Students

Most students live in shared apartments or on-campus houses to reduce costs of rental. Rent often includes utilities in dorms, but off-campus students should budget for internet, electricity, and heating. This is a table for the rentals of different room types and locations in Canada.

| Monthly Rentals for International Students (USD) | |

|---|---|

| Accommodation Type | Average Cost |

| 1B in City Centre | $1,345.71 |

| 1B outside the City Centre | $1,180.19 |

| 3B in City Centre | $2,131.87 |

| 3B outside the City Centre | $1,850.30 |

| On-Campus (Annually) | $5,840–$7,300 |

| Off-Campus (Shared Accommodation) | $292–$511 |

Average Cost of a House in Canada for Families

The average cost of a house in Canada is important to know for the family which wants to buy a house there. In 2025, the average price of a house in Canada is about $520,000 (approximately 700,000 CAD). The house prices vary greatly by region. Bigger cities like Toronto and Vancouver are among the most expensive places. The average prices often exceeding $800,000 to $1,000,000. In smaller cities like Regina, Moncton, or Winnipeg, you can get more affordable options. The prices would be ranging from $250,000 to $400,000. For families who are considering buying a home in Canada, the location is key. Choosing the right city can make a significant difference on the affordability and quality of life. The real estate prices in Canada are as follows:

- Price per square meter to buy apartment in city centre: 6,444.32$ (8,660.92 C$)

- Price per square meter to buy apartment outside of centre: 4,585.83$ (6,264.92 C$)

Cost of Living in Canada: Transportation Expenses

Transportation is an important part of living costs in Canada. Students can cost $60 to $110 monthly on average. Toronto, Vancouver, Montreal and some big cities have well-connected and reliable public transit systems. They can offer monthly passes of $70 to $130. Many universities also offer discounts for student transit passes. While taxis can be expensive. For example, Uber and Lyft are widely used in Canadian cities, but usually a short ride might cost around $10 to $20. Driving a car in Canada is even more expensive. The costs would be $300 to $500 monthly for paying the insurance, gas, and maintenance. However, this is often unnecessary for students living in urban areas with good public transport.

The transportation expenses in Canada are as follows:

| Transportation Expenses in Canada (USD) | |

|---|---|

| Category | Cost |

| One-way Ticket(Local Transport) | $2.56 |

| Monthly Pass | $74.89 |

| Taxi Start | $3.43 |

| Taxi 1km | $1.59 |

| Taxi 1hour Waiting | $26.92 |

| Gasoline (1 liter) | $1.15 |

Cost of Living in Canada: Food Expenses

Your lifestyle, location, and shopping habits would influence the amount of food expenses. Students spend about $200 to $400 for one month averagely on groceries and dining out. The cost of food in Canada can be divided into two parts: meals outside and cooking home. If you go shopping at those cheap stores like Walmart, No Frills, or Costco, this can help you save money. The cost for groceries of one person in a month is about $150 to $250. If you eat at affordable restaurants, you would spend about $10 to $20 for a meal. Eating out once or twice a week can bring an additional expense of $100 to $150 to your monthly food expenses.

Prices of Meals

The cost of meals in different kinds are as follows:

| Meal Prices in Canada (USD) | |

|---|---|

| Category | Cost |

| Inexpensive Restaurant | $18.25 |

| Meal for 2 People, Mid-Range Restaurant | $73.00 |

| McDonalds | $10.95 |

| Beer | $5.84 |

| Cappuccino | $2.11 |

| Coke/Pepsi | $1.15 |

| Water | $1.70 |

Prices of Groceries

The cost of groceries of the frequently used kinds such as eggs, milk, and cheese are as follows:

| Groceries Prices in Canada (USD) | |

|---|---|

| Category | Cost |

| Milk(1 liter) | $2.25 |

| Loaf of Fresh White Bread (500g) | $2.71 |

| Rice (1kg) | $3.67 |

| Eggs (12) | $3.53 |

| Local Cheese (1kg) | $11.44 |

| Chicken Fillets (1kg) | $12.22 |

| Beef Round (1kg) | $15.08 |

| Apples(1kg) | $4.19 |

| Banana(1kg) | $1.45 |

| Tomato(1kg) | $4.12 |

| Potato(1kg) | $2.69 |

Cost of Living in Canada: Health Care Expenses

The cost of living in Canada include the health care. Healthcare in Canada gets publicly funded. Most medical services are covered through taxes of residents, so there is no direct cost if you need medical services. Each province and territory in Canada follows their own health insurance plan, which typically includes doctor visit, hospital stay, and emergency care. However, dental care, prescription drugs, and vision care are not included. It often requires private insurance or out-of-pocket payment.

International students can obtain free ot premium provincial health coverage in some provinces through application to the relevant provinces. The average annual premium for health insurance ranges from 365 USD to 511 USD, according to the Canada Insurance Plan. International students often select well-known providers such as Alliance Global, Sun Life, Green Shield, and Manulife Financial. If the health insurance is not offered, students must obtain private health insurance. There are several private health insurance policies and costs.

- Imed: USD 164.25 for 3 months

- BC MSP Program: USD 54.20 for 1 month

- AMS/GSS Health and Dental Plan: USD 128.79 for 8 months

Cost of Living in Canada: Entertainment Expenses

In addition to studying life, there are many other experiences in Canada. For example, you can choose outdoor activities, cultural events, or the overall Canadian social scene show. These are affordable in the leisure time not a luxury.

| Cost of Entertainment in Canada | |

|---|---|

| Activity | Average Cost (USD) |

| Movie Tickets | $8.76-$14.60 |

| Concerts and live Performances | $21.90-$109.50 |

| Outdoor Activities (e.g., hiking, skiing) | $0-$73 |

| Cultural Events and Festivals | $0-$36.5 |

| Museum or Art Gallery Admission | $7.30-$21.90 |

| Theme Parks or Amusement Parks | $29.60-$59.20 |

| Sport Events | $22.2-$148 |

| Fitness Club, Monthly Fee for 1 Adult | $42.91 |

Cost of Living in Canada: Education Expenses

For students who are about to study here, you must learn about the tuition fees in Canada. Education costs can vary depending on the program, institution, and whether you’re an international or domestic student. In addition to tuition, students should budget for textbooks, materials, and additional academic fees, which can total around USD 300 – 600 per year.

Overall, while education in Canada can be expensive, it remains an attractive choice due to its high quality and the possibility of part-time work opportunities to support living expenses.

Average Tuition Fees for Undergraduate Courses in Canada

There are some frequent choices for undergraduate students.

| Tuition Fees for Undergraduate Courses in Canada (USD) | |

|---|---|

| Course | Tuition Fees |

| Business | $40,800 |

| Computers and IT | $40,150 |

| Engineering and Technology | $40,150 |

| Social and Natural Sciences | $3,8690-$40,800 |

Average Tuition Fees for Postgraduate Courses in Canada

There are some frequent choices for postdergraduate students.

| Tuition Fees for Postgraduate Courses in Canada (USD) | |

|---|---|

| Course | Tuition Fees |

| Business | $38,431 |

| Computers and IT | $38,325 |

| Engineering and Technology | $40,150 |

| Social and Natural Sciences | $27,010-$42,539 |

Popular Universities in Canada: Average Tuition Fees

There are some popular universities for students who want to study in Canada.

| Popular Universities in Canada (USD) | |

|---|---|

| University | Tuition Fees |

| University of Toronto | $4,453-$49,224 per year |

| Memorial University of Newfoundland | $8,423 per annum |

| Humber College | $21,535 per year |

| University of Regina | $14,836 per year |

| Royal Roads University | $20,075 per year |

| Thompson River University | $26,024.50 per year |

| York University | $5,224-$28,342 per year |

City Comparison: Toronto vs. Montreal vs. Halifax

| Expense Category (Monthly) | Toronto (ON) | Montreal (QC) | Halifax (NS) |

|---|---|---|---|

| 1-Bed Apartment (City Centre) | $2,580 – $2,750 | $1,650 – $1,800 | $1,770 – $1,900 |

| 1-Bed Apartment (Outside Centre) | $2,100 – $2,300 | $1,250 – $1,450 | $1,400 – $1,600 |

| Public Transit (Monthly Pass) | $156 (TTC) | ~$97 (STM) | $90 – $122 |

| Groceries (Single Person) | $400 – $500 | $380 – $450 | $480 – $550 (Higher food costs) |

| Utilities (Hydro, Heat, Water) | $180 – $250 | $100 – $150 (Lowest rates) | $200 – $280 |

| Dining Out (Mid-range, 2 people) | $100 – $120 | $85 – $110 | $90 – $115 |

| Est. Monthly Total (Single) | ~$3,600+ | ~$2,400+ | ~$2,700+ |

Tips to Save Life Expenses in Canada for Students

It is an exciting thing to live in Canada as a student, but your finance may be challenged. The tuition fees, rent, and daily expenses need to manage. However, there are lots of ways to save money without lower your quality of life.

- Affordable Housing: Opt for shared accommodations or on-campus housing.

- Public Transport: Use student transit passes or cycle to save on transportation.

- Smart Shopping: Buy groceries in bulk, plan meals, and look for student discounts.

- Limit Eating Out: Cook at home and pack lunch to save money.

- Student Discounts: Use ISIC cards and take advantage of student deals on services and entertainment.

- Free Entertainment: Attend free campus events and explore nature.

- Apply for Scholarships: Seek scholarships and bursaries to reduce tuition and living costs.

Comparison in Housing Expenses between Canada and Other Countries

Is the cost of accommodation high in Canada? Which is more affordable between Canada and USA? The rent Prices in Canada are 21.9% lower than in United States; The rent Prices in United Kingdom are 2.3% higher than in Canada; The rent Prices in Australia are 0.2% higher than in Canada.

| Cost of Accommodation for Students Comparison | |

|---|---|

| Country | Accommodation Cost (USD) |

| Canada | On-Campus: $5,688 to $7,109 annually Shared Off-Campus: $285 to $500 monthly |

| USA | On-Campus: $8,731 to $9,890 annually Shared Off-Campus: $401.06 monthly |

| UK | On-Campus: $493 to $739 monthly Off-Campus: $743 to $2,478 monthly |

| Australia | On-Campus: $65.73 to $167.29 monthly Off-Campus: $54.00 to $263.49 monthly |

Conclusion

If you manage your plan and budget properly, the cost of living in Canada is relatively affordable. Life expenses in Canada can be different according to the city and location of housing. Some tips to cut your costs make it possible to live comfortably for most students and newcomers. No matter where you choose to live, in a big city like Toronto or in a cheaper one like Winnipeg, it is important to know clearly your monthly expenses.

FAQ

What is the cost of living in Canada per month?

The average monthly cost of living in Canada for a student typically ranges from $2,500 to $3,000, depending on the city and lifestyle. It includes the rent, food, transport, utilities, health care and entertainment.

Is it expensive to live in Canada for international students?

Yes, living in Canada is expensive for international students. It is more affordable than living and studying in other countries like the US, the UK, or Australia. If you plan and budget the life costs carefully, take some part-time jobs, and apply for the student support, you can live comfortably in Canada.

Is it cheaper to live in the US or Canada?

The cost of living in Canada is cheaper than that in US. The cost of living in Canada is 6.3% lower than in United States (excluding rent). The cost of living Including Rent in Canada is 11.4% lower than that in United States.

Is it cheaper to live in the UK or Canada?

The cost of living in Canada is cheaper than that in UK. The cost of living in United Kingdom is 4.5% higher than that in Canada (excluding rent). the cost of living Including Rent in United Kingdom is 3.9% higher than that in Canada.

What are the cheapest places to live in Canada?

For students looking to save on housing and daily expenses, Winnipeg, Sherbrooke, and Moncton are among the most affordable cities in Canada. There are several other cities: Trois-Rivières, Quebec; Saint John, New Brunswick; Saskatoon, Saskatchewan; Thunder Bay, Ontario.

Is it expensive to live in Canada?

Yes, living in Canada is expensive. It is estimated that the cost of living in Canada per month for a single person is about 1,064.0$ (1,459.3C$), excluding rent. Although Canada is not the cheapest, it is more affordable compared with the US or the UK in many cases.

How much is rent in Canada in US dollars?

The average rent in Canada are: An apartment (1 bedroom) in City Centre is 1,344.62 $; An apartment (1 bedroom) Outside of Centre is 1,178.46 $; An apartment (3 bedrooms) in City Centre is 2,128.92 $; An apartment (3 bedrooms) Outside of Centre is 1,846.21 $.

How much money do I need to live comfortably in Canada?

$900 to $1,500 per month is needed if you want to live comfortably in Canada. Living comfortably in most Canadian cities, you can prepare $1,200 to $1,500 per month. In cheaper cities like Winnipeg and Sherbrooke, the cost is closer to $900 to $1,100. In big cities like Toronto and Vancouver, it is about $,400 to $1,800.