The purpose of renters insurance nyc is to protect the tenant’s personal property. If someone breaks into your rented student housing in nyc and steals it, the landlord is generally not liable. Unless you can prove that the landlord was negligent by not having locks on the windows and doors. If you suffer financial loss in your apartment due to an accident such as a burglary or fire. Renter Insurance nyc will pay for your loss. Coverage also includes losses caused by fire, vandalism and other disasters.

uhomes

If you are looking for a house rent in USA, uhomes is a good choice for you to choose apartment to live in New York, Los Angeles, Chicago, San Fransisco. There are different types of house for you to rent, and you can fill in a form. There will our consultant contact with you soon.

Why We Need Renters Insurance NYC?

1. Avoiding financial losses

When you to rent a student housing in New York, you may encounter any natural or man-made disasters. And your personal property will cause some damage. So after you buy renters insurance nyc, you will be able to be compensated for all of these things. The things include computers, and you will also be also be compensated for a new one.

2. Avoiding disputes

In the United States, if you accidentally let a toilet run, an appliance catch fire, or damage an interior wall. Painting walls, fixing floors and replacing appliances and such is often very expensive. It’s not something that can be solved by deducting a security deposit. This is a time when the landlord can hold you legally responsible if you abscond. So in order to avoid financial disputes with your landlord, renters insurance nyc is still necessary.

3. Mandatory requirement

The better apartment complexes in the United States will force you to purchase renter’s insurance. Most schools will also require students to purchase renters insurance. Some schools even make renter’s insurance a direct part of tuition. Renters insurance nyc can cover a wide range of things and is very necessary for tenants. And making it one of the most useful yet underestimated forms of insurance.

Renters Insurance NYC Claims Coverages

1. Personal Property

This includes items such as furniture, electrical fixtures, digital products, clothing and jewelry, etc. All tenant damages are covered by the insurance company in these situations. For example, the house has experienced fire, storm, explosion, damage caused by smoke, vandalism, and theft, among other factors. All of which can be claimed for. Renters insurance not only covers what’s inside your house, but what you bring with you is also covered. For example, a student who brings a laptop to school to study and it is stolen can file an insurance claim. Also if due to problems in your own house. It has caused someone else’s financial loss, the renter’s insurance you have can also pay for it. For example, let’s say the water pipe in your apartment cracks and your downstairs neighbor has a major flood in his house, his property damage can also be covered by your renters insurance nyc.

2. Liability

The most important part of renters insurance nyc should be this liability protection for third parties. For example, if someone falls and gets hurt in your home, renters insurance can cover their medical expenses. Things like x-rays, dental, calling an ambulance to the emergency room, hospitalization, surgery, etc. can all be covered. And even their lost wages during the time they miss work due to their injury. There is also a situation if your pet bites and scratches a visitor at home and needs to go for treatment. Renters insurance will be able to cover that medical bill. However, it is important to note that some pets are generally “blacklisted”, such as Pitbulls and Rottweilers and other animals that are aggressive by nature. They are not covered by most renters insurance policies.

3. Additional Living Expenses

When a home rented by an insured person is accidentally vandalized to the point where it is temporarily uninhabitable and you have to stay in a hotel. Renters insurance nyc covers the cost of renting a hotel. It will even reimburse you for the cost of meals and necessities.

4. Renters insurance generally does not cover the following situations:

- Damage caused by the owner’s own mistakes (e.g. if you accidentally lose your cell phone or computer)

- Damage caused by the owner’s pets.

- Special valuables such as paintings and jewelry (unless you have purchased additional insurance)

- Roommate’s property (your roommate will need to buy his/her own renter’s insurance, and international students need to pay special attention to this item when renting an apartment)

- Damage caused by man-made disasters, such as terrorist attacks or nuclear war.

- Damage caused by floods and earthquakes. If you live in an area that is prone to these two types of disasters, you will need to pay extra to have them counted in your renter’s insurance, and there are also some areas that will not cover these two types of natural disasters even if you pay extra.

How do I choose for renters insurance in NYC?

- First, you need to tally up your personal possessions. Calculate their total value. According to statistics, the average value of a tenant’s belongings is $20,000 dollars. However, many people underestimate it.

- After doing this step, you can start choosing the right insurance policy. It’s just like buying car insurance. Before you buy, shop around and compare different companies’ policies for premiums, coverage, and maximum payouts. Choose the most cost-effective one according to your needs. If you live in a high natural disaster area or have items that are particularly valuable but not covered by the basic plan. It’s also important to consider whether it’s worth getting an additional renters insurance policy.

Refer to the following criteria:

- Area Safety: When purchasing renters insurance nyc, the insurance company will assess the safety of the area you live in based on your zip code. The safer the region, the lower the premium, and vice versa; this is the same as car insurance.

- Safety of real estate: Insurance companies will also assess the security of your house. A large apartment with 24-hour security and an alarm system will be more secure than a private house, so the insurance cost is relatively low.

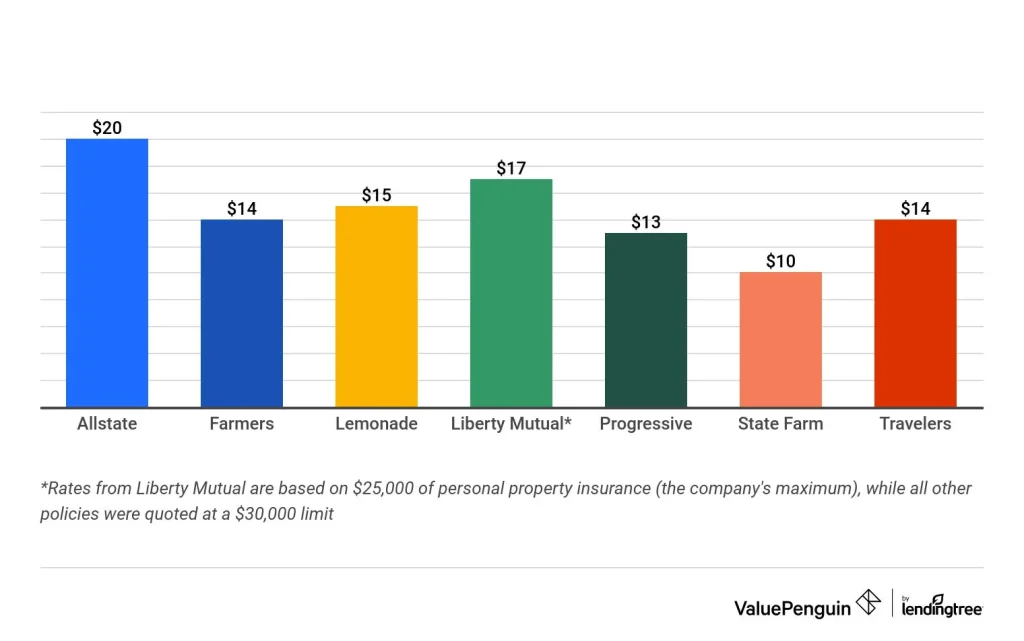

- Sum Insured: You can choose the coverage you want when purchasing insurance. The higher the coverage, the more expensive the premium. Below are some of the most common insurance policies in the United States:

$25,000 Personal Property Loss: Covers the cost of replacing stolen or damaged items.

$300,000 Liability: Covers attorney’s fees for damages or injuries in the policyholder’s apartment.

$2,000 medical insurance: Covers the medical expenses of a third party injured in the policyholder’s apartment.

$10,000 loss of use: This covers the insured’s extra living expenses, such as temporary lodging and food, if the apartment is uninhabitable.

How does renters insurance NYC Compensated?

If you hold renter’s insurance, after filing a claim, the insurance company will value your loss. Insurance companies usually offer two types of policies:

- Replacement cost policy: This is the amount of money that will be paid to re-buy the damaged/stolen item. For example, if your laptop is stolen, the insurance company will pay you to buy a new one at the same price.

- Actual cash value policy: This pays out the depreciated value of the item. For example, if the laptop you had stolen was 5 years old, the insurance company will pay you a sum of money based on the current value of the computer. Even if the money is not enough to buy a new computer, you will have to pay the difference out of your own pocket.

How Can I Buy a Renters Insurance NYC?

Apartments that require renters to purchase renter’s insurance. Several companies are usually recommended to the renter while they are checking in. The renter can choose from any of them. Some apartments offer to pay the insurance premiums on behalf of the renter for a monthly fee along with the rent.

Renters can also buy insurance directly from the insurance company without going through the apartment. Here is a list of insurance companies in the United States where you can buy renter’s insurance. It is straightforward to purchase directly from the official website. You can pay the insurance premiums monthly or altogether, depending on the length of your lease.

Renters Insurance NYC Company Recommendations

1. State Farm

State Farm is an American insurance company and financial services provider. It is headquartered in Bloomington, Illinois. It is located at #3 on the list of top insurance websites in the United States. State Farm is also one of the top 10 insurance websites in the United States due to its low premiums and high coverage plans.

Official Website:https://www.lemonade.com/ https://www.statefarm.com/

2. Geico

GEICO is the #2 auto insurance company in the United States. It also has renter’s insurance available, and the good thing about GEICO is that it’s really cheap. And the mobile app does a great job of making it easy to view and change policies.

Official Website: https://www.geico.com/

3. Allstate

Allstate was founded in 1931. And it is the second largest publicly traded property and casualty insurer in the United States. The company has more than 79,000 employees. Similar to State Farm Insurance. Goodwill has a list of local agents. Providing customers with a variety of insurance needs. The 2023 World’s 500 Most Valuable Brands list was released and Goodwill was ranked #205.

Official Website: https://www.allstate.com/renters-insurance.aspx

4. Lemonade

Lemonade is an insurance company founded in New York in 2016. It primarily provides property insurance for landlords and tenants of houses, condominiums, co-ops, and independent apartments. The interface of their home app process is very user-friendly. Perfect for college students.

Official Website:https://www.lemonade.com/

5. Nationwide

Nationwide Mutual Insurance Company is a Fortune 100 company. It paid more than $18 billion in claims and other benefits to members in 2017. The company operates in multiple vertical industries (including financial services, commercial and personal lines) in all 50 states. Since 2000, Nationwide Mutual has contributed more than $430 million in funding to nonprofit organizations.

Official Website:https://www.nationwide.com/

How to get the best discounts?

cons of each company or are curious about what discounts are available to you. You can also use tools like SafeButler to compare side-by-side. The combination is based on your coverage amount and some of the features of your apartment.

- Combination discounts

If you have your own auto insurance. Then you can usually get a discount on your auto insurance after you purchase renters insurance. For example if the discount is 5% and your auto insurance is $1,000 per year. So if you spend $150 on renter’s insurance, then your auto insurance is reduced by $50. So you’re effectively spending the equivalent of $100 on renter’s insurance. Note that sometimes it may be cheaper for you to purchase a separate policy than 100.

- Good Credit

Insurance companies treat people with good credit. So if your credit score is above 700, you can usually get a better price. Whether it’s renter’s insurance or any other type of insurance, you can sometimes get about 5% off the price.

- Pay in full or Paperless

With some insurance companies, you can get an extra 5% or so off if you pay in full or choose Paperless.

The cost of renters insurance in NYC can vary depending on factors such as the coverage amount, deductible, and location within the city, but on average, it typically ranges from $15 to $30 per month.

Renters insurance is not mandatory by law in New York City. But landlords may require tenants to purchase a policy as part of their lease agreement. Even if not required, renters insurance is highly recommended to protect personal belongings and provide liability coverage in case of accidents or unforeseen events.

Yes, renters insurance is worth it because it provides financial protection for your personal belongings against theft, fire, and other covered perils, as well as liability coverage in case someone is injured in your rental unit. The relatively low cost of renters insurance compared to potential losses makes it a valuable investment for tenants.

In New York, the most common type of renters insurance is still the HO-4 policy, which offers coverage for personal belongings, liability protection, and additional living expenses. This policy is widely used by renters across the state, providing comprehensive coverage tailored to their needs.

It is not illegal to not have renters insurance in New York City. However, landlords may require tenants to purchase a policy as part of their lease agreement, and not having insurance could potentially leave renters financially vulnerable in case of accidents or losses.