For international students and tourists arriving in Australia, receiving domestic and international remittances and handling transfer transactions are common tasks. Most people choose to transfer money through banks, such as Commonwealth Bank, ANZ Bank, or other banks. However, there are many other convenient transfer methods that few people know about. To facilitate easier transfers in Australia, today uhomes.com has compiled a list of common transfer methods in Australia, as well as comparisons of limits, processing times, fees, and other aspects between each method. Whether you are transferring money domestically within Australia or internationally, these remittance methods can be useful.

1. International Bank Transfer trough Commercial Banks

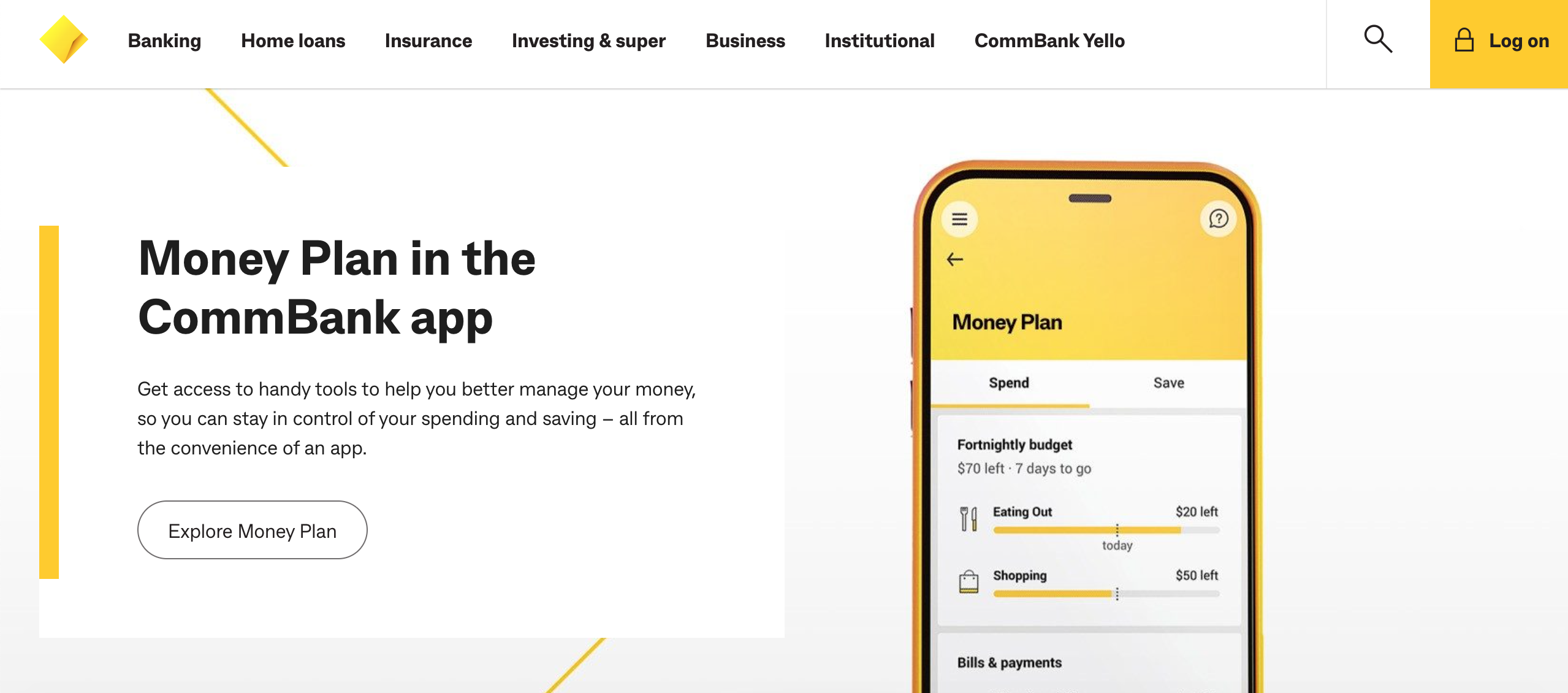

1.1 Commonwealth Bank

The Commonwealth Bank of Australia, headquartered in Sydney, is the second largest commercial bank in Australia, established in 1912. Most international students typically have accounts with Commonwealth Bank, which has numerous ATMs and branches in the city. Common locations like Central, Bourke, and within the University of Melbourne campus have service counters. With such a robust bank, it naturally offers a variety of transfer services. Through the CommBank app, NetBank, or nearby branches, you can send international money transfers (IMT) to over 200 countries/regions in more than 30 currencies.

Commonwealth Transfer Limits:

If you’re using NetBank or the CommBank app, the maximum daily transfer limit is AU$5,000. However, if you need to transfer more than AU$5,000, you can visit a branch or call Commonwealth (13 2221) for assistance.

Commonwealth Overseas Transfer Fees:

1. For transfers made in-branch, there’s a fee of AU$30 per transaction.

2. For transfers made via NetBank or the CommBank app (converting funds from an Australian dollar account to foreign currency), there’s a fee of AU$6 per transaction.

3. For transfers made via NetBank or the CommBank app (funds debited and credited in Australian dollars without currency conversion), there’s a fee of AU$22 per transaction.

4. For transfers made via CommBiz, there’s a fee of AU$6 per transaction.

5. If you cancel or amend a transfer, there’s a fee of AU$25 per transaction.

Commonwealth Transfer Processing Time:

Transfers typically take 1-3 business days. However, international transfers may take longer depending on the recipient’s bank and country/region. It’s also worth noting that transfers made on weekends, public/bank holidays, or after currency cutoff times will be processed on the next business day.

1.2 ANZ Bank

ANZ (Australia and New Zealand Banking Group), headquartered in Melbourne, is one of the major commercial banks in Australia, established in 1835. It is a longstanding financial institution with branches in Beijing, Shanghai, Guangzhou, Chengdu, Chongqing, Qingdao, and Hangzhou in China. ANZ also pays significant attention to the Chinese market locally in Melbourne, offering specialized services for international students. See below for transfer limits, fees, and processing times.

ANZ Transfer Limits

Customers with personal accounts may request daily limits of AU$1,000, AU$5,000, or AU$10,000. Customers with business accounts may request daily limits of AU$5,000, AU$10,000, AU$15,000, or AU$25,000. ANZ Internet Banking for Business users can request an increase in limits up to AU$1,000,000.

Note: Even if your daily limit is higher, the maximum amount for international transfers through ANZ Banking for Business is AUD150,000.

ANZ Overseas Transfer Fees

There are slight differences between phone transfers and online banking.

| Transfer Method | Destination | Amount ≤ AUD 10,000 | Amount > AUD 10,000 | |

|---|---|---|---|---|

Cook Islands, Fiji, French Polynesia, Guam, Kiribati, New Caledonia, Papua New Guinea, Samoa, Solomon Islands, Timor-Leste, Tonga, Vanuatu |

|

| ||

| Telephone Transfers | ||||

All other countries/regions |

|

|

| Transfer Method | Destination | Amount ≤ AUD 10,000 | Amount > AUD 10,000 | |

|---|---|---|---|---|

Cook lslands, Fiji, French, Polynesia, Guam, Kiribati, NewCaledonia, Papua New Guinea,Samoa, Solomon lslands, Timor.Leste, Tonga, Vanuatu |

|

| ||

| Online Banking Transfers | ||||

| All other countries/regions |

|

|

1.3 National Australia Bank

NAB (National Australia Bank), headquartered in Melbourne, is Australia’s largest commercial bank, established in 1858. The Classic Account offered by NAB is said to be the top choice for international students. Moreover, NAB has branches in Beijing and Shanghai, China. For specific limits and fee details, please see below.

NAB Transfer Limits

The default daily limit for international fund transfers through NAB online banking is AU$5,000. If you wish to transfer more, please contact NAB customer service at 1300 651 656 between 7 am and 9 pm on weekdays and 9 am to 6 pm on weekends (AEST / AEDT).

NAB Overseas Transfer Fees

When making international transfers in foreign currency, there is a fee of $10 per transaction. For international transfers in Australian dollars, there is a fee of $30 per transaction. This fee should be paid according to the terms and conditions applicable to all payable fees associated with using this service.

NAB Arrival Time

Typically, international transfers from NAB require 1-3 business days, depending on the currency and country/region involved. Once you initiate a transfer through NAB, the funds will leave your account within 1 business day.

1.4 WestPac

Headquartered in Sydney, it is the first bank and the first company in Australia, with a proud history of 192 years. For specific limits and fee details, please see below.

WestPac Transfer Limits

You can change your daily payment limit (up to $10,000) using online banking or the Westpac app. If you need to raise the limit above $10,000, you can contact their customer service at 132 032 (international: (+61 2) 9155 7700).

WestPac Overseas Transfer Fees

Lower fees apply when sending international payments in foreign currency:

- $10 for payments made in foreign currency via online banking

- $20 for payments made in Australian dollars via online banking

- $32 for payments made in any available currency at a branch

- $10 for branch transfers to a Pacific Westpac account

In addition to fees charged by WestPac, international payments may incur additional charges and fees deducted by overseas banks involved in the international payment process (other bank fees) and/or the recipient’s bank.

WestPac Arrival Time

Funds typically transfer electronically from your Westpac account to the designated overseas account within 1-3 business days.

2. International Bank Transfer through Online Platforms

2.1 Xoom

As a service under PayPal, Xoom allows you to easily remit money, recharge mobile phones, and pay bills for family and friends worldwide. You can make international transfers as long as you have the recipient’s email or phone number. If the recipient does not have a PayPal account, it’s not a problem; they can open a PayPal account upon receiving the remittance reminder. There are no fees for transfers within Australia using PayPal; however, for international transfers, PayPal charges a small fee plus a remittance fee.

You can not only complete transfers through the website but also download the app to make transfers and remittances via mobile devices, which is very fast and convenient! Additionally, Xoom provides multiple languages, eliminating language barriers and making remittance easier.

Remittance Steps:

Step 1: Log in to Xoom using your PayPal account and password, or easily create an account using your name and email address.

Step 2: Enter the remittance amount, recipient details, and the recipient’s address in China.

Step 3: Conveniently complete the transfer by using PayPal, bank account, credit card, or debit card for payment.

Advantages:

- Quick and convenient.

Disadvantages:

- Additional transaction processing fees, cash withdrawal fees.

2.2 Remitly

Remitly, founded in 2011, is a company based in Seattle, USA, that provides online transfer services. It now supports transfers from as many as 17 countries to 85 countries worldwide, catering to the needs of the vast majority of international students and expatriates. Remitly’s service mission is to be fast, convenient, transparent, and affordable, and its global network technology indeed provides users with a superior remittance experience.

Additionally, Remitly’s remittance services can be operated online or through the downloaded application on mobile devices, ensuring completeness. Moreover, the website offers multilingual pages, which undoubtedly is its greatest advantage, allowing users to complete transfers effortlessly and without barriers.

Advantages:

- New customers enjoy zero fees for their first transfer; they can also benefit from limited-time promotional exchange rates.

- Fixed fee policies for some countries are suitable for large transfers.

- Enjoy preferential international exchange rates, with remittance and receipt amounts displayed promptly and clearly.

- Easy operation on mobile devices; besides using the web version, users can also download the app and directly operate all necessary functions on their mobile devices, greatly improving efficiency.

- Offers both EXPRESS and ECONOMY transfer services.

- Extremely fast transfer speed, with funds typically arriving within 3 business days.

- Supports instant transfers to Alipay, which is extremely convenient for domestic recipients accustomed to using Alipay.

- Offers a variety of payment methods; in Australia, payment via bank account is quite common.

2.3 Western Union

Western Union, as a company primarily focused on express remittance services, has been established for over 250 years. Its parent company is First Data Corporation (FDC). Western Union provides international remittance services to customers worldwide.

Generally, with Western Union, funds can arrive as quickly as 15 minutes. After completing the remittance process, the sender informs the recipient of the remittance details and the Money Transfer Control Number (MTCN). Upon receiving the notification, the recipient identifies the Western Union logo and proceeds to the nearest bank or Western Union agent to collect the remittance. The recipient needs to fill out a “Receive Form” and present valid identification. It’s important to note that the recipient must personally collect the remittance and cannot authorize someone else to do so.

The specific remittance process is as follows:

1. Visit a Western Union agent location to fill out the “Send Form.”

2. Submit the completed form, the funds, the remittance fee, and personal identification documents.

3. After the remittance is completed, receive a receipt with the Money Transfer Control Number (MTCN) printed on it.

4. Inform the recipient of your name, the remittance amount, the MTCN, and the country/region from which the remittance was sent.

Advantages:

- Swift delivery of funds.

Disadvantages:

- High transaction fees.

- Limited support for banks.

2.4 Panda Remit

Different from traditional cross-border remittance methods such as banks and Western Union, Panda Speed Remittance omits the intermediary bank link and directly connects remitters and recipients. Therefore, it can achieve remittance within 3 minutes. Remittances can be easily completed via mobile phones, eliminating the hassle of queuing and waiting, and can be done online 24/7. Additionally, because Panda Speed Remittance does not have many offline stores, it saves a lot of offline operating costs, resulting in much cheaper fees. Currently, Panda Speed Remittance adopts a fixed fee per transaction model. Taking Australia as an example, with a single transaction limit of 4000 AUD, the fee is only $5.99 AUD per transaction, making it the most cost-effective personal remittance method available.

Transfer Fee: $5.99 AUD

Advantages:

- Low fees, fast arrival time

Disadvantages:

- Less popularity compared with other online remittance platforms.

Information Required by Panda Remit:

1. Remitter’s basic information, residential address, passport, or Australian driver’s license.

2. Recipient’s identification: Chinese mainland second-generation ID card.

3. Bank card: The remitter must possess a debit card issued by a bank in their country.

2.5 Transferwise

TransferWise is also a great international remittance platform where funds can arrive in just one minute, and they are received directly based on real-time exchange rates. It allows you to hold and manage over 40 currencies, helping you avoid exchange rate fluctuations and prepare for future transfers.

Fees:

For example, when remitting AUD 1000 from Australia to the United States, a fee of AUD 6.01 is charged. The fee is slightly higher compared to Commonwealth Bank, OrbitRemit, and PayPal, but lower than most banks and transfer platforms in Australia.

2.6 PaySend

- Low fees, no exchange rate difference.

Disadvantages:

- Remittance amount is limited.

2.7 Wold Remit

WorldRemit is a service platform for international remittances and transfers, supporting transactions in up to 90 currencies across 150 countries. The exchange rate varies depending on the receiving method chosen by the user.

Fees:

- Charged as a percentage of the transaction!

Advantages:

- Fast arrival time, wide selection of receiving methods.

Disadvantages:

- Government-issued identification documents are required after the first transfer.

3. Tips for International Bank Transfer

- Compare Fees and Exchange Rates: Different banks and money transfer services may have varying fees and exchange rates. Compare these factors to find the most cost-effective option for your transfer.

- Check Transfer Limits: Ensure that the transfer amount you want to send falls within the limits set by your bank or chosen money transfer service.

- Consider Transfer Speed: If you need the funds to arrive quickly, choose a service with faster transfer speeds. Some services offer same-day or next-day transfers, while others may take several business days.

- Understand Additional Charges: In addition to the transfer fee, be aware of any additional charges such as intermediary bank fees or currency conversion fees. These can impact the total cost of your transfer.

- Be Cautious of Fraud: Be wary of scams or fraudulent schemes, especially when transferring large sums of money internationally. Only use trusted and reputable money transfer services, and avoid sharing sensitive information with unknown parties.

- Seek Assistance if Needed: If you’re unsure about any aspect of the international bank transfer process, don’t hesitate to seek assistance from your bank or financial advisor. They can provide guidance and answer any questions you may have.

If you’re thinking about studying in the Australia, it’s crucial to find the right student accommodation. That’s where uhomes comes in. It’s a reliable platform that helps students like you find the perfect place to live in Melbourne, Sydney, Brisbane, Adelaide, Canberra and many other cities. So far, they’ve helped more than 55,000 students successfully find their dream homes.

FAQ

Once an international bank transfer has been initiated, it may be difficult or impossible to cancel or modify, especially if the funds have already been processed or if it’s a same-day transfer. It’s important to double-check all transfer details before initiating the transaction to avoid any issues.

The time it takes for an international bank transfer to go through can vary depending on factors such as the countries involved, the banks’ processing times, and the chosen transfer method. In general, transfers can take anywhere from one to five business days, although some services offer faster options for an additional fee.

International bank transfers are generally considered secure, especially when using reputable banks or transfer services that employ encryption and other security measures to protect your financial information. However, it’s important to remain vigilant and ensure that you’re using trusted platforms and verifying the recipient’s details to minimize the risk of fraud or errors.

If you are interested in Australia study life. Please check following blogs!