Whether you plan to work, study, or travel in Australia, one of the most important tasks upon arrival is to open bank account. Opening a bank account is essential for life in Australia, as banks provide services such as storage, consumption, payment, and financial management. A reliable bank card is crucial for daily life. So, which banks are available in Australia? Which type of account is best to open? How do you choose from the famous “big four” banks in Australia? Which bank card is most suitable for you? What is the process for opening a bank account in Australia? If you are preparing to open a bank account in Australia, this comprehensive guide from uhomes will surely help you!

1.Before Opening Bank Account Online or Offline

1.1 Different Types of Australian Bank Account

Australia generally has two common types of bank accounts: transaction accounts and savings accounts. However, many banks also offer specialized accounts for students, with specific differences outlined below:

| Account Type | Description |

|---|---|

| Transaction Account | The most common type of account used for daily expenses, allowing withdrawals, deposits, bill payments, and purchases using a debit card. It does not earn interest. |

| Savings Account | Primarily used to earn interest, requiring a transaction account to be opened first. Recommended to open both accounts together. Money can be transferred from the transaction account to the savings account to earn interest. |

| Student Account | Specialized accounts offered by many banks, providing exclusive services such as fee waivers for account maintenance. International students can also consider these accounts. Fees for transactions and taxes on interest may be waived. |

Tips

- It’s recommended that everyone opens two accounts when applying for an account.

- Keep different amounts of money in different banks, as there are slight differences in the types of deposit accounts.

- Regularly check their statements to avoid overdrawn and penalties.

2. How to Open Bank Account Online or Offline?

2.1 Materials required

- Passport

- Printout of Visa

- Letter of Offer from the school or institution

- Electronic Confirmation of Enrolment (eCoE)

- Rental address

2.2 Methods of Opening a Bank Account in Australia

- Online Application

- It is possible to apply for a bank account in Australia before arriving there, as most banks now offer online account opening services. When applying online, you typically need to provide information such as your passport number, email address, the date and city of your arrival in Australia, and some banks may also require your mobile phone number.

After arriving in Australia, you need to visit the branch you selected during the online application process to activate the card and open the account. However, you won’t receive the card on the spot; it will be mailed to the address you provided about a week later.

- In-Person Account Opening at Bank Branch

- Alternatively, you can wait until you arrive in Australia to open a bank account. It is advisable to do this within six weeks of your arrival. You will need to provide your visa and passport as proof of identity. If your English proficiency is limited, some banks in Sydney and Melbourne have staff who can speak Chinese. Make sure to ask if you have any questions or uncertainties during the application process, and don’t be shy to seek clarification!

3. Common Australian Banks

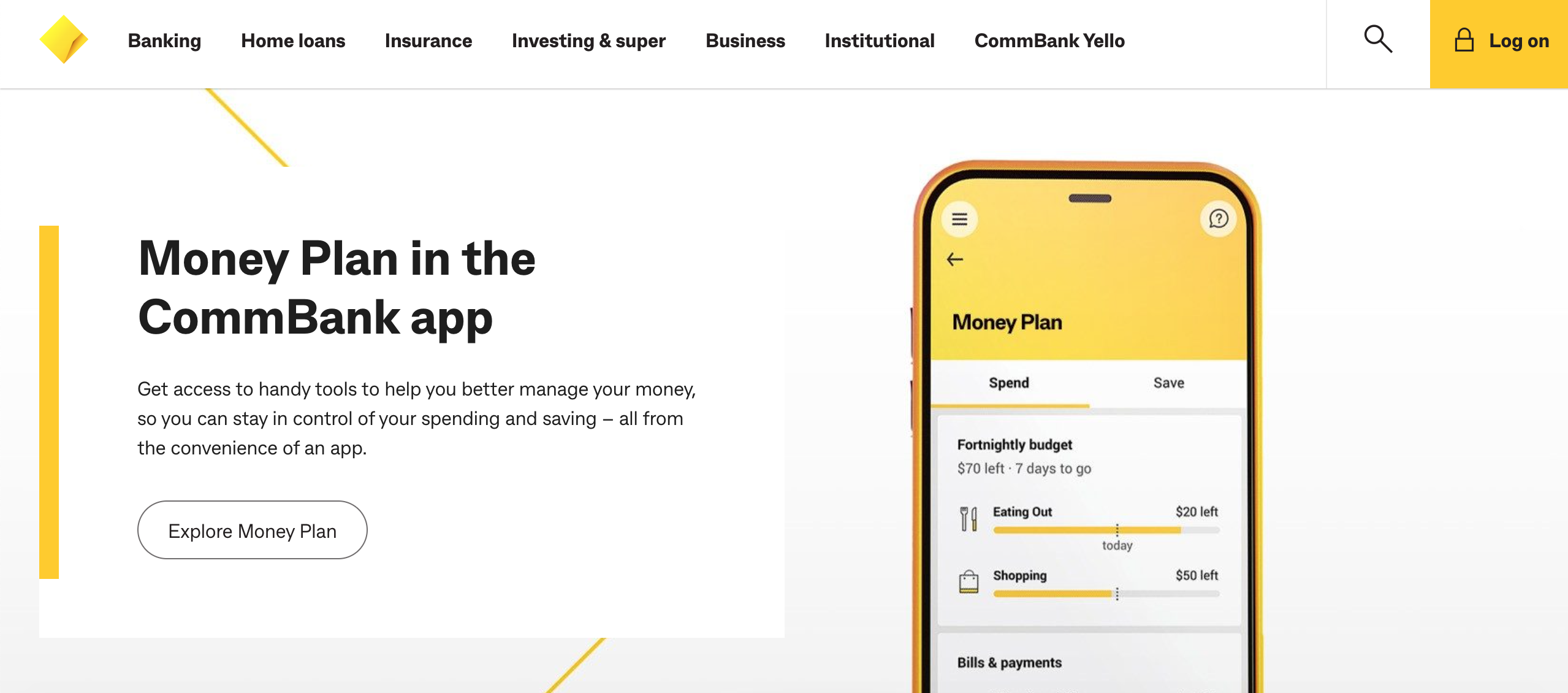

3.1 Commonwealth bank

The Commonwealth Bank of Australia (CBA), headquartered in Sydney, is one of the four major banks in Australia. They offer free student accounts, which many students choose, making their branches and ATMs widely available (you can find their ATMs at almost every 7-11), making withdrawals very convenient. The CBA mobile app and banking website are among the best, and they also offer insurance services and student credit cards. CBA offers a range of benefits and convenience for international students, supporting online application. Students can open a bank account with CBA online within the first three months of arriving in Australia.

Advantages:

1. Real-time payment functionality: Every transaction is recorded in the payment history.

2. Cardless cash withdrawal feature.

3. Ability to transfer money to CBA users using phone numbers, without needing BSB and account numbers.

4. Specialized credit card services for students: Almost every student receives a credit card invitation from Commonwealth Bank with low thresholds, making it a good option for impulse buyers. Especially useful when overseas transfers are delayed, having a credit card can help you survive when you don’t receive your living expenses on time.

5. You can apply for Paytag: Search for Paytag on the official website, it costs around $3.99, and Commonwealth will mail you a small card according to your billing address. You can stick it anywhere you like, allowing you to leave your bank card at home. When you want to pay with your card, simply tap your phone on the POS machine, and for transactions under $100, you can make contactless payments without a PIN, which is very convenient.

3.2 ANZ Bank

ANZ Bank, headquartered in Melbourne, is one of the four major banks in Australia and is considered one of the oldest and most reputable banks in the country, ranking among the top 50 globally. ANZ Bank is a public company established in the state of Victoria, Australia, and is listed on the Australian Securities Exchange. It is authorized to conduct banking operations in Australia under the Banking Act (Federal) of 1959 and is regulated by the Australian Prudential Regulation Authority. ANZ Bank also provides student accounts without annual fees and offers specialized services for international students. Additionally, the bank’s mobile app and website are highly convenient for customers.

Advantages:

- The only bank supporting Apple Pay to date, enabling transactions without carrying a physical card, just your phone.

- Can issue debit cards for students aged 16 and above.

- The website is very user-friendly and easy to navigate.

3.3 WestPac

The Westpac Banking Corporation (WBC) is the oldest bank in Australia, originating from the Bank of New South Wales, established in 1817. With financial agencies across the Asia-Pacific region and globally, Westpac’s online banking system is comprehensive, allowing for business settlements, foreign exchange, domestic and international payments, stock trading, and more. Its primary operations are focused in Australia, New Zealand, and the Pacific Islands. Westpac merged with Challenge Bank in Western Australia in 1995, Trust Bank New Zealand in 1996, and Melbourne-based Bank of Melbourne in 1997.

3.4 National Australia Bank

The National Australia Bank (NAB) is Australia’s largest commercial bank, founded in 1858. It was incorporated in 1893 and became a limited company in 1984. Headquartered in Melbourne, the National Australia Bank is a leading banking and financial services organization in Australia, offering a wide range of financial industry services without any fees. It has a global network covering Australia, the United States, the United Kingdom, New Zealand, as well as Asian regions such as China, Singapore, and Japan.

Advantages:

1. Among the four major banks in Australia, NAB has the smallest service scope, with personal banking services targeting only 3 million people.

2. It has branches in Shanghai and offices in Beijing.

3. NAB Reward Saver: (1) Enjoy a monthly interest rate of 2.55% (variable, subject to bank’s announcement) by only depositing without withdrawing each month; (2) If withdrawals are made from this account, the interest rate will be reduced to 0.5% (variable, subject to bank’s announcement).

3.5 Other Recommended Banks

St.George Bank:

St.George Bank is the fifth largest bank in Australia, providing valuable services to the Australian public. The close relationship between St.George and its customers is reflected in the high level of praise customers give to the bank compared to other banks.

HSBC Bank:

HSBC Bank offers a variety of financial services in Australia. With over 7,000 branches in 81 countries worldwide, it is headquartered in London.

Citibank Australia:

Citibank Australia offers a wide range of flexible banking services in Australia, with empathetic bank staff providing appropriate services to customers.

Tips:

When choosing to open a bank account in Australia, consider the following points:

- Is the bank conveniently located near your residence or school for easy transactions?

- Does this bank offer free account services or frequent promotions?

- What is the interest rate on savings accounts provided by this bank?

3.6 Common payment methods in Australia

- Debit Credit Card: Australian debit cards come with Visa PayWave or MasterCard PayPass functionality, allowing for contactless payments for purchases under $100 without needing a PIN. Simply tap the card on the EFTPOS machine to pay.

- If you forget your wallet, you can still withdraw money from your bank’s ATM using Cardless Cash Withdrawal via the mobile banking app.

- You can transfer money using just a phone number, eliminating the need for the recipient’s bank account details. This makes splitting bills with friends easier – just transfer money to your friends’ phone numbers using online banking after dining out.

- There is a growing trend towards cashless transactions. Supermarkets have self-checkout counters with options for card-only payments, where only card payments are accepted.

- Apple Pay allows for mobile payments using Apple devices, such as iPhones or Apple Watches.

4. Considerations When You Open Bank Account Online and Offline

Bank Fees

Before opening a new bank account, it’s essential to understand what fees you might incur. Some banks may charge monthly account fees just for opening an account. However, in some cases, you may be exempt from monthly fees if you meet specific requirements, such as maintaining a minimum balance or completing a certain number of transactions per month using a Mastercard debit card or Visa card.

Although monthly account fees and other charges are common, not all bank accounts in Australia will incur these fees. Some Australian banks offer accounts that are free from monthly fees and transaction charges. However, even with these accounts, there may still be circumstances where fees are applied, such as overdrawing the account or using a debit card while traveling abroad.

Accessibility

Some banks in Australia have branches nationwide, while others have branches only in specific regions. Additionally, some banks operate exclusively online without physical branches.

When choosing which bank to open an account with in Australia, consider how you prefer to conduct banking transactions. If you prefer to visit a branch in person, you may want to choose a bank with branches near your residence, workplace, or school.

Those who frequently withdraw cash may be interested in the bank’s ATM locations. On the other hand, individuals who prefer to conduct all banking transactions online may prioritize the usability of the bank’s website or mobile application.

Customer Service

Whether you primarily access your Australian account online or frequently visit branches for transactions, customer service is an important consideration.

Reading online reviews written by Australian residents can provide insights into the bank’s reputation and the customer service options they offer.

5.Open Bank Account Online and Offline - The Process

5.1 Open bank account online

1. First, go to the CBA bank’s official website and click on the corresponding account type under “bank” to begin creating a personal account.

2. Then choose whether you are a new user and proceed to the next step (usually, when applying for a bank account in Australia for the first time, you need to select the “new customer” option to register).

3. Enter your detailed information, including your name (as shown on your ID), date of birth, email and mailing address, and phone number.

4. Next, create a password, and verify the password.

5. Finally, choose whether you need to add a NetBank Saver account to complete the online registration.

5.2 Open bank account offline

Materials Needed

Passport, COE (Confirmation of Enrolment) or student card, mobile phone, address, etc.

Basic Steps

First, make an appointment with the branch manager to open an account. Then, go through the account opening process with the serving staff. During this process, they will introduce some special deposit and wealth management services to you. If you encounter anything you don’t understand, be sure to clarify and don’t agree blindly.

After the Account is Opened

Generally, it takes 5-10 working days for the bank card to be delivered to your address. At the same time, the bank will provide you with the account number and the code needed for remittance, making it convenient for you to deposit and remit money directly. They will also help you set up your mobile app so that you can complete transfer operations.

If you’re thinking about studying in the Australia, it’s crucial to find the right student accommodation. That’s where uhomes comes in. It’s a reliable platform that helps students like you find the perfect place to live in Melbourne, Sydney, Brisbane, Adelaide, Canberra and many other cities. So far, they’ve helped more than 55,000 students successfully find their dream homes.

FAQ

The operating hours for most Australian banks are as follows:

- Monday to Thursday: 9am-4pm;

- Friday: 9am-5pm;

Some banks may offer limited services on Saturday morning 9.30am – 12pm;

Closed on Sundays and public holidays.

Australian banks require international students to visit the bank for identity verification within six weeks of arriving in Australia. The first six weeks after arrival in Australia serve as a deadline. During this period, banks only require a passport as identification to open an account for international students. If the deadline of six weeks is exceeded, the bank will follow its policy, and the student will need to provide documents totaling 100 points to verify their identity before the account can be opened.

Account Number: This is the number of the account you have opened with the bank. If you open the account online, you can find it in the email you receive after opening the account. If you open the account at the bank in person, the bank will print it out for you on the spot. The account number from CBA typically has 8 digits and is used when others transfer money to you.

Card Number: This is a row of numbers on the front of your bank card, usually consisting of 16 digits. It is used when you make purchases online or pay for goods. Under one bank account, there can be multiple bank cards, such as debit cards, credit cards, etc., and each card has a different card number.