Opening a bank account in Australia is also essential because Australia does not encourage cash transactions. Many financial transactions can only be run through a bank transfer account; at the same time, a bank card can provide many conveniences, such as foreign exchange, money transfers, shopping credit cards, bank exchange rates, etc. Some merchants do not support cash payments, so a bank card is indispensable in Australia.

Before I talk about opening a bank account, I would like to introduce you to the four central banks in Australia. These are also the four banks that most international students choose. Each has special accounts for overseas students and provides different degrees of preferential treatment.

Banking in Australia: Commonwealth Bank of Australia

Commonwealth Bank of Australia (CBA) is the first of the four central banks in Australia. It is headquartered in Sydney and has many branches in major cities. This bank is also the main target of introduction; because of its convenience and preferential facilities, many international students will choose it.

Official website: https://www.commbank.com.au/

Advantages:

- In many branches and ATMs, depositing and withdrawing money is very convenient, with no commission. Also, provide cardless withdrawal and cardless deposit, cell phone verification can be done, do not worry about forgetting the card can not get money;

- provide a free student account with a high interest rate for the first three months;

- the mobile app is handy. Transferring cash and checking are very convenient and safe;

- provide insurance business, and have 24-hour customer service;

- If the bank card is lost, the old card will be frozen after the loss is reported, and the new card information will be updated automatically after 15 minutes.

Account Types

Combank will provide two accounts, Smart Access and Netbank, similar to Alipay’s Balance and BalanceBank. Smart Access is equivalent to Balance, the balance on your bank card, and Netbank, comparable to BalanceBank, where you put your money into Netbank to get interest.

Peer Transfer

There are three types of peer-to-peer transfers: account number transfer, cell phone number transfer and code transfer.

You need to input more information for the account transfer, but it is a real-time transfer.

You need to input your cell phone number for cell phone transfer. If the amount is significant, receiving the money will take two days.

Scan code transfer is a little different from domestic scan code transfer. After the transfer, you need to provide a code to your friend so that your friend can enter the code to receive money. Although it is more troublesome, the security is very high.

Inter-bank Transfer

The safest way is to fill in all the account information to ensure that there will be no mistakes. The first interbank transfer may be slow but is usually instant afterwards. However, if you make an essential payment such as a rent deposit, transfer the money three or four days in advance.

Banking in Australia: Australia & New Zealand Bank

Australia & New Zealand Bank is one of the four largest banks in Australia. It is a Fortune 500 company headquartered in Melbourne and a highly reputable commercial bank in the global banking community.

Official website: https://www.anz.com.au/personal/

Advantages:

- provide student accounts with no annual fee and also offer specialised services for international students;

- high security and separation of receiving and paying accounts;

- multiple accounts to meet different savings requirements (details below)

- When opening a savings account, you can apply for a credit card simultaneously, with no annual fee for the first year, and sometimes with campaigns.

- the mobile app is also very good to use, security and convenience of doing a good job, you can also open Apple Pay and Android Pay.

- If you lose your bank card, the old card will be frozen after you report it lost, and the new card information will be updated automatically after 15 minutes.

Account Types

1. Access Advantage Account

There is usually a $5/month management fee for a daily spending account; international students are exempt from management fees. The balance of this account is the balance of the bank card. You can check the balance through the app or the bank’s official website, or you can check the balance in an ANZ ATM for free. However, if you use another bank’s ATM, there will be an extra charge.

2. Online Saver

Like Commonwealth Bank’s NetBank Saving, it is an online savings account with no management fee, minimum deposit requirement, and free transfer in and out. You can also earn interest; new customers who open an account within three months will receive additional interest.

3. Progress Saver

Longer term savings account, no management fee, if you want to get interest, you need to deposit at least $10 per month and have no withdrawal record. If there is an urgent need to deposit money, you can withdraw it once a month for free, but you will lose interest for that month. Starting from the second deposit, each ATM or in-store credit card swipe is $ 1/ trip, over-the-counter withdrawal is $2.5/trip, and online banking transfer is free.

Banking in Australia: Westpac Bank

Westpac Bank is Australia’s oldest bank, headquartered in Sydney and New Zealand’s second-largest bank.

Official website: https://www.westpac.com.au/

Advantages:

- Offers two packages for young people, one for those under 21 years old and the other for full-time university students. Both packages are free of administrative fees, and there are no fees for withdrawals or deposits, as well as cardless cash withdrawals;

- The only Australian bank among the four central banks that do not charge overseas ATM fees in its international network and the only Australian bank that offers zero handling fee for foreign exchange;

- The mobile app’s security and convenience are good; it is easy to transfer money and make payments.

Banking in Australia: National Australia Bank

Headquartered in Melbourne, NAB is the largest commercial bank in Australia, with some branches in major cities.

Official website: https://www.nab.com.au/

Advantages:

- No annual fee (this is quite advantageous for ordinary customers, but since other banks offer convenient policies for students, it is not very beneficial for international students). 2;

- a “Classic” account, open to people over 18 years of age, with a VISA debit card (which can be used both online and abroad);

- offers contactless payment with payWare.

- Offers an “iSaver” account, which allows customers to transfer deposits without membership or transaction fees and at a reasonable interest rate.

- mobile apps and websites that are easy to use, convenient and efficient.

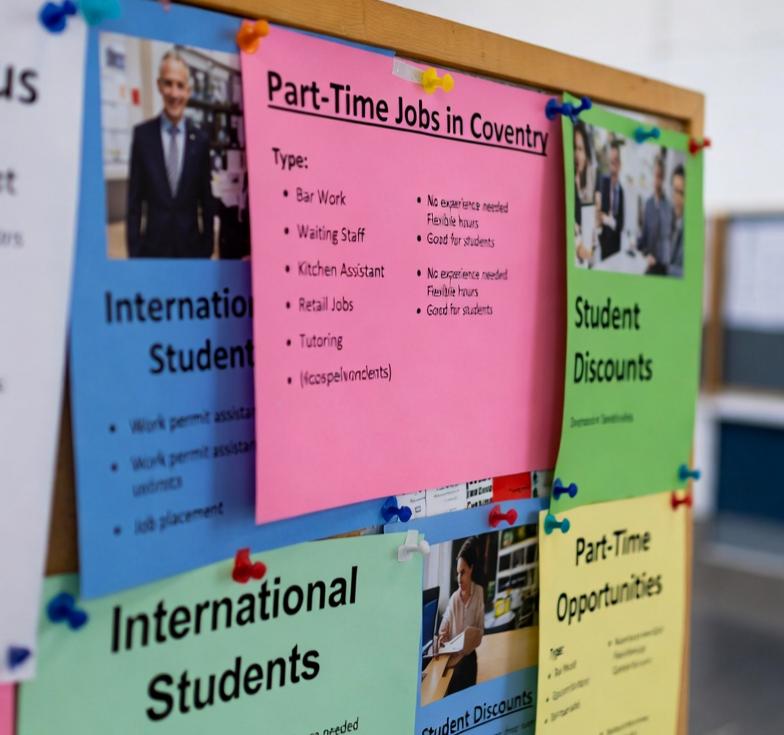

The four central banks in Australia all offer student accounts specifically for international students. Benefits generally include no fees, unlimited cash withdrawals, no minimum deposits, etc. There are differences between banks, so it is vital to find out in as much detail as possible before opening an account if there are any other limitations on the terms of the bank’s account offer.

Consider the Elements:

- when opening an account, consider whether there is a branch of this bank where you live, go to school and shop regularly;

- compare high and low interest rates;

- the number of ATMs (Commombank has the most significant number);

- the convenience and service of the mobile app.

Australia Bank Account Opening Process

Generally, you can choose between handling your bank card online and offline. The oil strip to the Commonwealth Bank of Australia (Commonwealth Bank) is an example to help you understand the specific process.

Online Processing

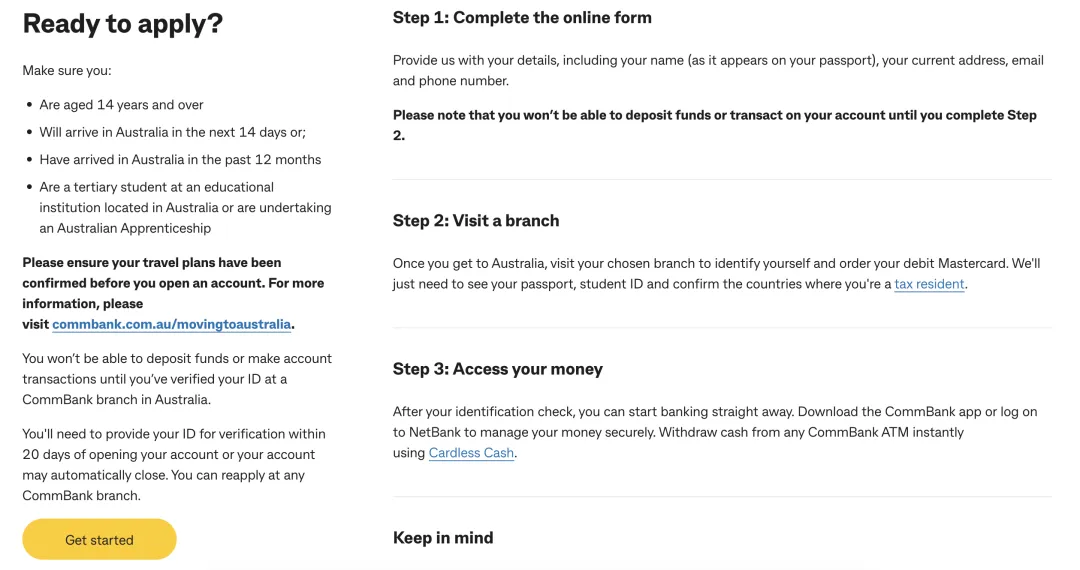

Online account opening is not a mandatory step. You can also walk into the bank directly after arriving in Australia, but you will likely encounter a queue. However, opening an online account can save students a lot of time.

Step 1

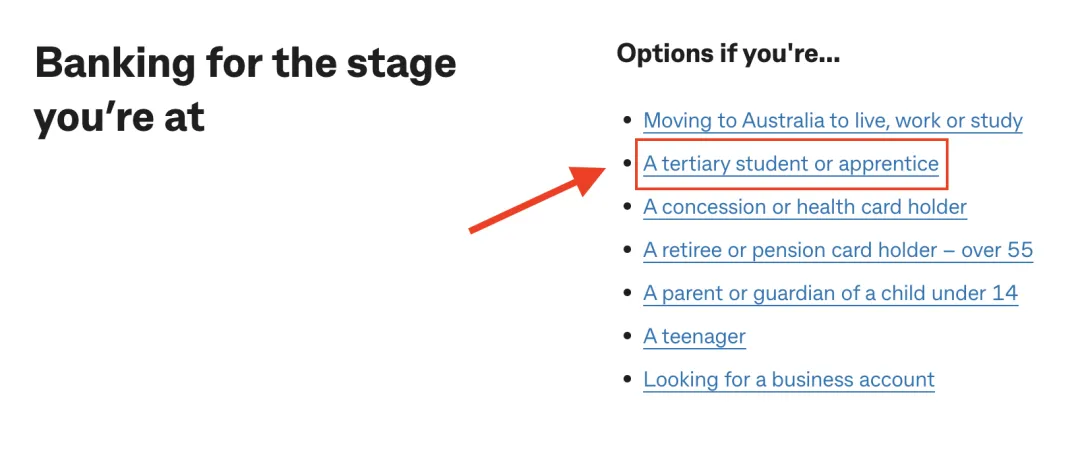

Go to the bank’s official website https://www.commbank.com.au/ and click Bank&savings accounts under Banking;

Step 2

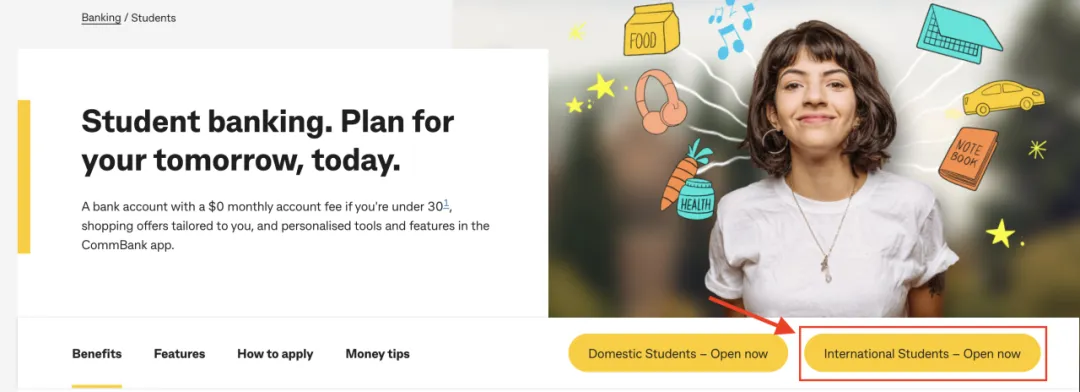

Scroll down to find A tertiary student or apprentice, enter and click International Students – Open now;

Click on Get Started to start the specific account information to fill out;

Step 3

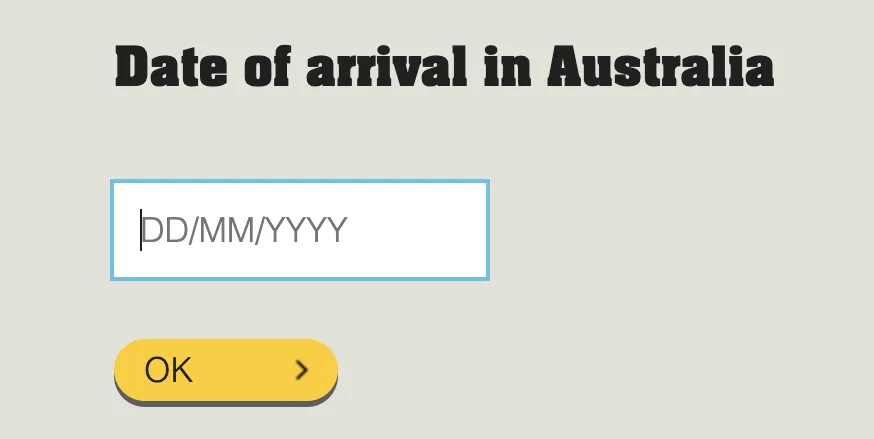

1. Fill in the date of arrival in Australia (you can only choose the past three months or the next 14 days);

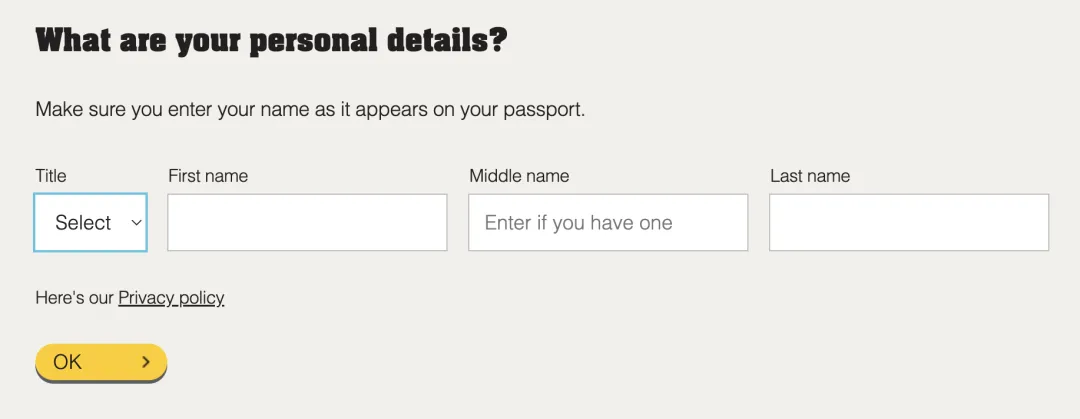

2. Fill in your name (make sure it is the same as your passport);

2. Fill in your name (make sure it is the same as your passport);

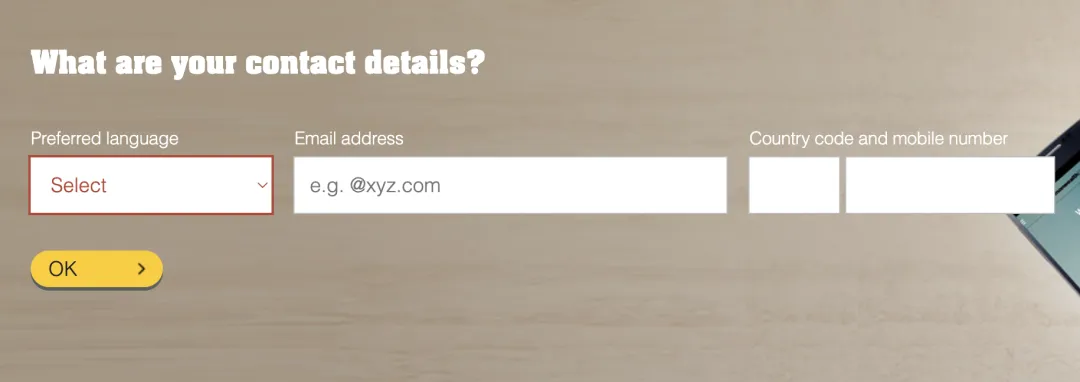

3. fill in the common language and contact information (can fill in the domestic cell phone number);

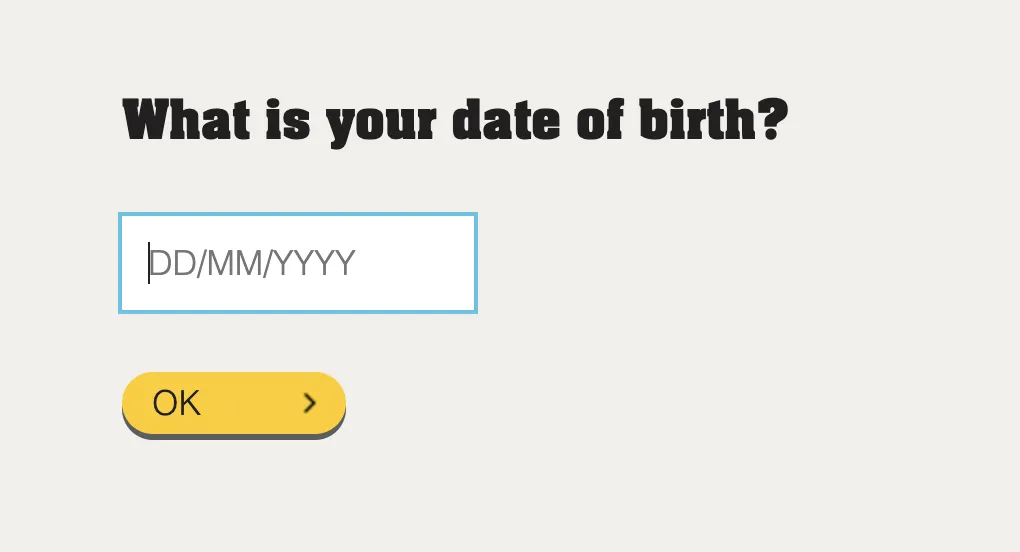

4. fill in the birthday;

5. fill in the current address (Australia or domestic can be);

6. choose an offline processing branch (it is recommended to choose a branch closer to the address);

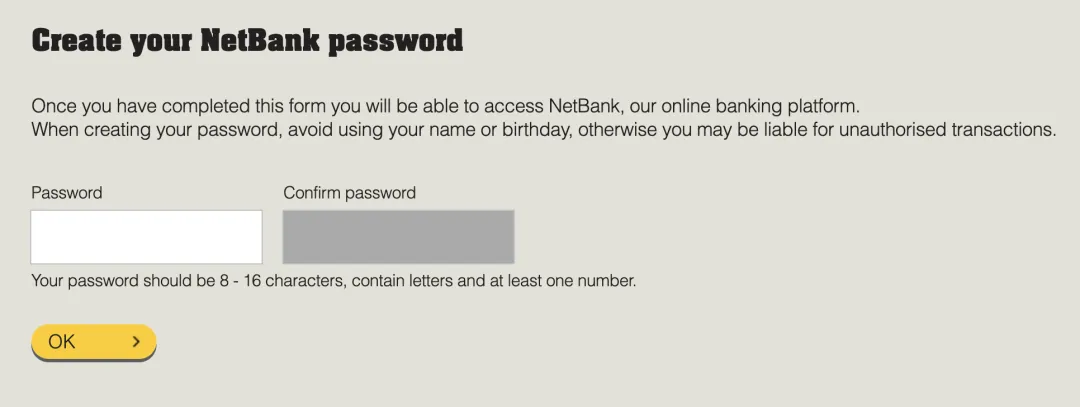

7. Finally, create an 8-16 digit password containing letters and numbers.

After completing all the information, you will receive a welcome letter from the bank, which you can print out. When you arrive in Australia, take the welcome letter, passport, visa, student card, and COE, download the bank’s app in advance, and go to the previously selected branch to get your bank card. It is recommended that you get it within 20 days of entering Australia!

Offline Processing

Step 1

Prepare passport, visa, COE, and other necessary documents. The student card is exempt from the monthly fee until the COE expires, so be sure to bring it!

Step 2

Most of the Australian banks are open from Monday to Friday from 9:00 am to 4:00 pm, a few will be open on Saturday from 9:30 am to 12:00 noon, public holidays are not open, before opening an account on Google maps to determine a good time, no need to make an appointment.

The account opening will be more crowded during the peak period, but students can still call the business office to find out. After arriving at the bank branch, you can tell the staff at the front desk that you are a new international student and want to open an account. The staff will introduce you to more details, such as the bank’s interest rate, exchange rate, related activities, preferential treatment, etc. If your English is not very good, you can ask if you can open an account.

If your English is not very good, you can ask if there is a Chinese service, as larger branches have services for different languages. Then, you only need to provide the appropriate information.

Step 3

During the process of opening your card, the staff will ask you to download their app and teach you how to use it, you can also download it in advance, so that you can pay your rent, utility bills and even tuition fees in the future.

Step 4

After the above process, the bank card will be mailed to your reserved address within 7-14 working days, so make sure you fill in the address accurately!

Banks usually don’t send out notifications that it has been mailed or arrived, so be sure to pay more attention! If you’ve been waiting more than ten days, remember to contact your bank to see if it’s been lost in the mail. If it is lost in the mail, notify the bank promptly to send a replacement card. Once you get your card, follow the instructions provided by your bank to activate your card on the app.

About Tax File Number (TFN)

When you go to the bank to open an account, the staff will also ask whether you need to bind TFN to your account. The oil bar here roughly explains TFN processing and its use.

In Australia, as long as the money is dealt with, it includes tax, so applying for a tax number is very important. TFN and our passport numbers are the same and unique; even if you apply for other visas, this number will not change.

According to Australia’s tax law, all the people who work (have income) in Australia must have their own TFN; for international students, you have to get your TFN number before applying for a part-time job because the company will ask you to provide your TFN number, so that they can deal with the payroll and tax business (this does not include the exceptional cases, such as some black workers), when you get your salary, the boss will deduct the tax from your salary before giving you the final wage, this time if you do not have the TFN number, you can apply for the TFN number. When you get your salary, the boss will deduct the tax from your salary before giving you the final salary. If you don’t have a tax ID number now, you will be subjected to a very high tax rate of more than 40%.

Australia Bank Account Cancellation Process

For students in Australia who want to cancel their bank accounts, it is elementary to go directly to the bank to find staff to communicate and cancel or call to cancel. Still, the waiting time will be longer, and it is not as convenient as offline operation.

Attention:

Before cancelling the account, you must make sure that the balance in the account is 0;

It is recommended that you operate on weekdays; the manual acceptance will be very fast, and it can be completed about a day later.

Book Student Accommodation in Australia

If you want to study in Australia and renting an apartment is a big problem, uhomes.com offers a vast range of affordable and comfortable student accommodation for Australian students at the cheapest student flat rentals! You can rent luxury or budget suites, studio flats, and private and shared rooms with various amenities at student accommodations in Melbourne, Perth, Adelaide, Canberra, and Brisbane.

FAQ

Can a foreigner open a bank account in Australia?

Of course you can. Most banks allow you to apply for a bank account online in Australia, but you will still need to visit a bank branch in person to prove your identity.

What is the best bank to open an account with in Australia?

Among the most reputable institutions, banks such as Commonwealth Bank, ANZ, Westpac and NAB consistently lead the way. Ultimately, the best bank for you will depend on your specific requirements, but these institutions offer trustworthy and forward-thinking options that are worth considering.

Can I open a bank account online in Australia?

Yes, you can open a bank account online in Australia. Many of Australia’s major banks offer the convenience of opening an account via their website or mobile app. The process of opening an account is simple and efficient, usually requiring only some personal information and a valid ID. This means you can manage your finances from the comfort of your own home, ensuring both security and ease of use.

Which bank is fast to open in Australia?

Key competitors known for their efficiency include Commonwealth Bank and ANZ. Commonwealth Bank has a robust digital service that allows potential customers to open an account online in minutes, as long as all required documents are prepared. Similarly, ANZ offers a streamlined account opening process through a user-friendly mobile app.