To truly identify the wealthiest city in the United States, one must analyze where global capital congregates. According to the 2025 USA Wealth Report by Henley & Partners and New World Wealth, the nation’s financial elite remain clustered in specific powerhouses like New York City, the Bay Area, and Los Angeles. However, while millionaire counts show accumulated wealth, recent U.S. Census Bureau data reveal the staggering reality of annual household income across these top tiers.

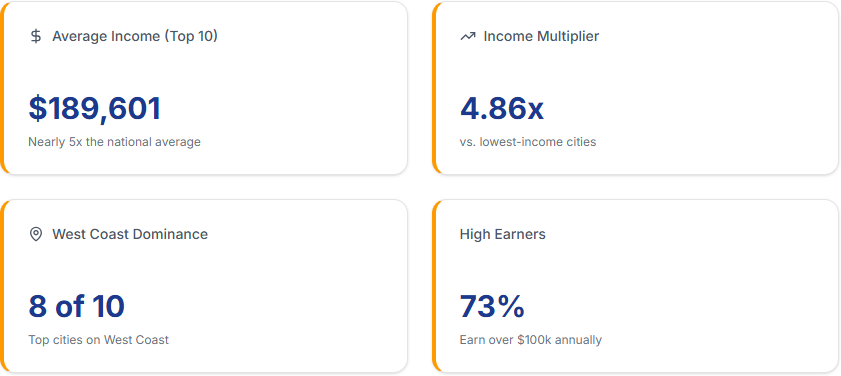

As the data illustrates, the economic divide in 2025 is stark. The average household income in these top-tier enclaves has reached $189,601, representing a massive 4.86x multiplier compared to the nation’s lowest-income cities. Perhaps most striking is the geographic shift shown in the bottom-left quadrant: West Coast dominance is undeniable, with California and Washington claiming 8 of the top 10 spots for highest median income. In these hyper-wealthy hubs, a 6-figure salary is no longer an outlier but the baseline—73% of households now earn over $100,000 annually, fundamentally reshaping the cost of living and entry barriers for students and young professionals.

For international students, these numbers are a roadmap. They indicate where the highest salaries, most robust internships, and most powerful networks are located. Below, we break down the richest cities in the US for 2025 to help you navigate this landscape of opportunity.

Breaking down the Wealthiest City in the United States

Before dissecting the lifestyle and costs of individual cities, let’s look at the raw data that defines the wealthiest places in America. We examine two critical dimensions: the concentration of High-Net-Worth Individuals (HNWIs) and the sheer economic output (GDP).

Cities with the Most Millionaires in the US

| City/Region | Millionaires (USD 1m+) | Centi-Millionaires (USD 100m+) | Billionaires (USD 1bn+) | Millionaire Growth % (2014 to 2024) |

|---|---|---|---|---|

| New York City | 384,500 | 818 | 66 | 45% |

| The Bay Area | 342,400 | 756 | 82 | 98% |

| Los Angeles | 220,600 | 516 | 45 | 35% |

| Chicago | 127,100 | 295 | 25 | 24% |

| Houston | 81,800 | 210 | 16 | 75% |

| Dallas | 72,400 | 135 | 16 | 85% |

| Seattle | 53,100 | 127 | 11 | 48% |

| Boston | 45,000 | 112 | 8 | 40% |

| Miami | 38,800 | 180 | 17 | 94% |

| Austin | 32,000 | 90 | 10 | 90% |

- Source: Henley & Partners USA Wealth Report 2025

The distribution of private wealth in 2025 highlights a distinct bifurcation between established financial capitals and emerging “Sun Belt” powerhouses. New York City retains its crown as the sheer volume leader, housing over 384,000 millionaires, largely driven by traditional finance and legacy estates. However, the Bay Area (San Francisco & San Jose) exhibits the highest density of extreme wealth, boasting 82 billionaires—the most of any metro area—fueled by the tech sector’s equity liquidity. Notably, the momentum has shifted southward; cities like Austin (+90%) and Miami (+94%) have nearly doubled their millionaire populations in just a decade, reflecting a mass migration of wealth seeking favorable tax environments and improved quality of life.

Richest Cities in the U.S. by GDP per Capita

| Rank | Metro Area | Population | GDP (Millions USD) | GDP per Capita |

|---|---|---|---|---|

| 1 | New York City | 19.5M | $2,298,868 | $116,883 |

| 2 | Los Angeles | 12.8M | $1,295,361 | $101,100 |

| 3 | Chicago | 9.4M | $894,862 | $95,200 |

| 4 | San Francisco | 4.7M | $778,878 | $165,700 |

| 5 | Dallas | 8.1M | $744,654 | $91,900 |

| 6 | Houston | 7.5M | $696,999 | $92,900 |

| 7 | Washington D.C. | 6.4M | $714,685 | $111,600 |

| 8 | Boston | 4.9M | $610,486 | $124,500 |

| 9 | Seattle | 4.1M | $566,742 | $138,200 |

| 10 | Miami | 6.2M | $533,674 | $86,100 |

- Source: U.S. Census Bureau & BEA (2024/25)

While individual wealth tells one story, the macroeconomic data from the U.S. Census Bureau and Bureau of Economic Analysis (2025 estimates) reveal the sheer productivity of these urban engines. New York City’s metro area generates a staggering $2.3 trillion in GDP, an economic output rivaling entire G7 nations. Yet, when adjusted for population, the San Francisco Bay Area demonstrates unparalleled economic efficiency, commanding a GDP per capita of over $165,000—significantly higher than the national average. This disparity underscores that while cities like Dallas and Houston are growing rapidly due to population influx, the coastal tech and finance hubs remain the most potent generators of value per resident.

10 Wealthiest Cities in America

When choosing where to establish your life and career in the US, it is helpful to categorize these wealthy cities by their economic “personality.” New York City, the Bay Area, and Los Angeles are the “Old Guard” of the American economy. They represent the highest barrier to entry but offer the most prestigious rewards. If the coastal giants are about “high risk, high reward,” Chicago, Houston, and Dallas offer the “American Dream” at a discount. They are wealthy, but your dollar goes significantly further. Seattle, Miami, and Austin are the cities of the future—places where wealth is growing at breakneck speed, driven by tech migration and lifestyle seekers. Below, we explore these top richest cities in the US in depth to help you find your best fit.

1. New York City: Financial Fortress

As the undisputed wealthiest city in the United States, NYC holds more private wealth (over $3 trillion) than most G20 nations. It is the nerve center of global finance, home to the NYSE and NASDAQ. The density of millionaires here (384,500) creates a unique ecosystem where luxury is the standard, yet the cost of living forces a stark reality check.

Income Reality: While the median income is ~$85,800, the cost of living is 125% above the national average.

Retirement: Retiring comfortably requires a nest egg of over $1.5 million due to high rents and healthcare costs.

Student Takeaway: The networking is unparalleled, but you are competing for NYC housing with the world’s wealthiest workforce.

2. The Bay Area: Innovation Engine

While NYC has the most millionaires, the Bay Area (San Francisco & San Jose) holds the crown for billionaire density. This is the richest part of America for tech wealth, driven by the Silicon giants of Apple, Google, and Nvidia. The region has seen its millionaire count nearly double (+98%) in a decade.

Income Reality: 64% of residents earn over $100k, the highest concentration in the nation.

Retirement: Extreme. Housing costs are 245% above the national norm. You need $2.2 million+ to retire here comfortably.

3. Los Angeles: Creative Capital

LA’s wealth is visible, glamorous, and driven by the export of culture. As the American richest city for entertainment, its wealth is concentrated in hillside enclaves like Bel Air and Malibu. Unlike the vertical wealth of NYC, LA’s affluence is sprawled across a massive geographic basin.

Income Reality: 44% of households earn over $100k, but transportation costs eat into disposable income.

Retirement: A comfortable retirement requires approximately $1.6 million.

4. Chicago: The Midwest Anchor

Chicago is an anomaly: a world-class economic engine with a cost of living that is manageable. It ranks as one of the wealthiest cities in the USA, yet rents here are nearly half of what you would pay in Manhattan. It offers a diversified economy (finance, manufacturing, logistics).

The Value: Average rents hover around $2,300—significantly lower than NYC for comparable amenities.

Retirement: Achievable with around $1.1 million.

5. Houston: The Energy Giant

Houston is the richest city to live in the USA if you prioritize purchasing power. As the global energy capital, it attracts massive corporate wealth. The lack of state income tax, combined with low housing costs, makes it a magnet for professionals.

The Value: Living costs are roughly 5% below the national average.

Retirement: One of the most affordable retirement destinations ($830k nest egg).

6. Dallas: The Corporate HQ

Dallas has quietly become a corporate superpower, growing its millionaire population by 85% in 10 years. It offers a sophisticated, “New South” lifestyle that blends luxury consumption with a business-friendly tax environment.

The Value: Moderate costs (2% above the national average) and no state income tax make it highly attractive.

7. Seattle: Tech Titan of the North

Seattle shares the Bay Area’s tech DNA but retains its own distinct character. Home to Amazon and Microsoft, it is one of the richest cities in the U.S. per capita.

The Trend: Wealth here is young and highly educated. Rents are high (~$2,200+), but the lack of income tax softens the blow for high earners.

Retirement: Costly, requiring nearly $1.2 million.

8. Boston: Intellectual Hub

As the world’s largest biotech and education center, Boston’s wealth is rooted in stability and research. Home to 45,000 millionaires, 112 centi-millionaires, and 8 billionaires, the city operates as a massive engine for the knowledge economy.

- Income Reality: With a median household income of ~$97,791, approximately ~49% of residents earn over $100,000 annually.

- Retirement: Very High. The median rent for a one-bedroom apartment is approximately $3,616, rivalling NYC. Retiring in Massachusetts is pricey, often requiring a nest egg of $2.22 million.

- Student Insight: Boston is a “college town” on a massive scale. While Boston housing is expensive and competitive (September 1st move-in madness is real), uhomes.com can help you secure verified apartments in Allston or Cambridge well in advance.

9. Miami: Capital of Capital

Miami has evolved from a vacation spot to a serious financial hub (“Wall Street South”). With a 94% surge in millionaires, it is the USA’s richest city for those fleeing high-tax states.

The Trend: Rents have spiked to $2,700+, rapidly eroding its former reputation as a cheap destination.

Retirement: Becoming exclusive; you now need close to $1 million to retire comfortably.

10. Austin: Silicon Hills

Rounding out the list is Austin, the fastest-growing wealth hub (+90%). It represents the intersection of tech innovation and Texas affordability.

The Trend: Rents have actually cooled recently to $1,527, making it a prime “buy the dip” opportunity for students.

Which Cities Are Becoming Wealthier?

While New York and the Bay Area remain the undisputed kings of capital, the momentum is shifting South. Austin (+90%) and Miami (+94%) are the clear leaders in millionaire growth.

This migration is fueled by the “Tax and Sun” thesis: high-net-worth individuals are leaving high-tax states (CA, NY) for zero-income-tax states (TX, FL). For students, this signals a strategic opportunity: entering these markets now allows you to ride the wave of economic expansion before the cost of living fully catches up to coastal levels.

How Does Wealth Influence the Economy?

The concentration of wealth in the top richest cities in the us creates a double-edged sword known as “Billionaire Blowback.” On the positive side, massive tax revenues fund world-class public transit (NYC), free museums, and safe neighborhoods. It creates a robust job market for high-end services.

However, there is a downside. Luxury real estate becomes an investment vehicle, sitting empty while driving up land values. This pushes students and the middle class further away from campus or city centers to find affordable housing. Understanding this phenomenon is key: the wealthiest cities in the united states offer the highest career ceilings, but the first rung of the ladder is much higher off the ground.

How uhomes.com Can Help You?

Living in the wealthiest city in the United States shouldn’t require you to sacrifice your financial future. Whether you choose the established prestige of Boston or the booming potential of Austin, the high costs are navigable with the right partner.

uhomes.com is designed specifically to help international students unlock these cities without the stress:

Zero Service Fees: Unlike local brokers in NYC who charge thousands in fees, we charge zero service fees on our listings.

Verified Listings: In wealthy cities, scams are common. We verify our properties so you can book with confidence from abroad.

VR & Video Viewings: Can’t fly to Los Angeles or Chicago to view a room? Use our VR tools to inspect your future home remotely.

Price Match Guarantee: We ensure you aren’t paying a “foreigner premium.” You get the best market price, guaranteed.

Ready to launch your career in America’s richest hubs? Search for your perfect apartment on uhomes.com today and turn the challenge of high rent into the opportunity of a lifetime.

Conclusion

The landscape of the wealthiest city in the united states is far more than a leaderboard of billionaires; it is a dynamic map of opportunity, industry, and lifestyle. From the established financial corridors of New York City and the tech-driven hills of the Bay Area to the rapidly expanding frontiers of Austin and Miami, each city offers a distinct value proposition for international students. While the “Old Guard” cities provide unmatched prestige and salary potential, they demand a high cost of entry. Conversely, emerging hubs offer a compelling blend of affordability and growth, allowing you to stretch your student budget further without compromising on career prospects.

Ultimately, your choice depends on your personal and professional goals. Whether you are chasing the energy of Wall Street, the innovation of Silicon Valley, or the tax-friendly boom of the Sun Belt, success lies in strategic planning. Understanding the economic reality—from rent burdens to cost of living indices—is the first step. By leveraging resources like uhomes.com to secure verified, fee-free housing, you can navigate these competitive markets with confidence, turning the challenge of high costs into the launchpad for your American dream.

FAQs

What percentage of American households make more than $200,000?

According to the most recent U.S. Census Bureau data covering 2023, approximately 14.4% of American households generate an annual income exceeding $200,000. This level of income places a household roughly in the top 15% of earners nationwide, accounting for nearly 20 million households in total. However, this figure fluctuates significantly based on geography, as high-cost metropolitan areas like San Francisco and Washington, D.C. have much higher concentrations of these high-income earners compared to rural regions or states with a lower cost of living.

Which city is richest in the USA?

San Jose, California, consistently ranks as the richest major metropolitan area with the highest median household income (approx. $136,000) due to Silicon Valley tech salaries; however, when including smaller residential enclaves, the town of Atherton, California, is the wealthiest zip code in the nation with average incomes often exceeding $500,000, while New York City remains the undisputed king of total wealth, holding the highest concentration of millionaires and billionaires in the country.

In which city do most billionaires live?

According to the most recent 2024 and 2025 global wealth rankings (including data from Forbes and Hurun), New York City is home to the most billionaires, with approximately 120 to 129 residents holding ten-figure fortunes. While Beijing briefly claimed the top spot in 2021, it has since dropped to fourth or fifth place due to economic shifts, leaving the “Big Apple” as the clear leader, followed variously by London, Moscow, and Hong Kong, though the broader San Francisco Bay Area often rivals New York if the entire region (including Silicon Valley) is counted as one entity.