Ordinary people have always been seeking the safest and most suitable ways to save money. Whether it’s the Z-generation who just received their salary or the working people saving for their mortgages and children, these best money saving apps have become the financial managers for many people. These money saving apps can stop impulsive consumption and convert fragmented time into quantifiable wealth growth. Therefore, choosing a truly suitable best apps for saving money UK will be the first step in your financial management.

An overview of apps to help save money

There are numerous available apps to save money in the app store. But which one is more suitable for you? Some people need a current account with immediate fund transfer, while others need a tiered fixed deposit. Different needs can choose different savings apps. The following are the best money saving apps in the UK at present.

- TodayTix

- Too Good To Go

- Olio

- TopCashback

- StudentBeans

- Groupon

- Plum

- Moneybox

- Chip

- Monzo

Top 10 money saving apps [Details]

Here is the introduction to these best saving apps for your reference.

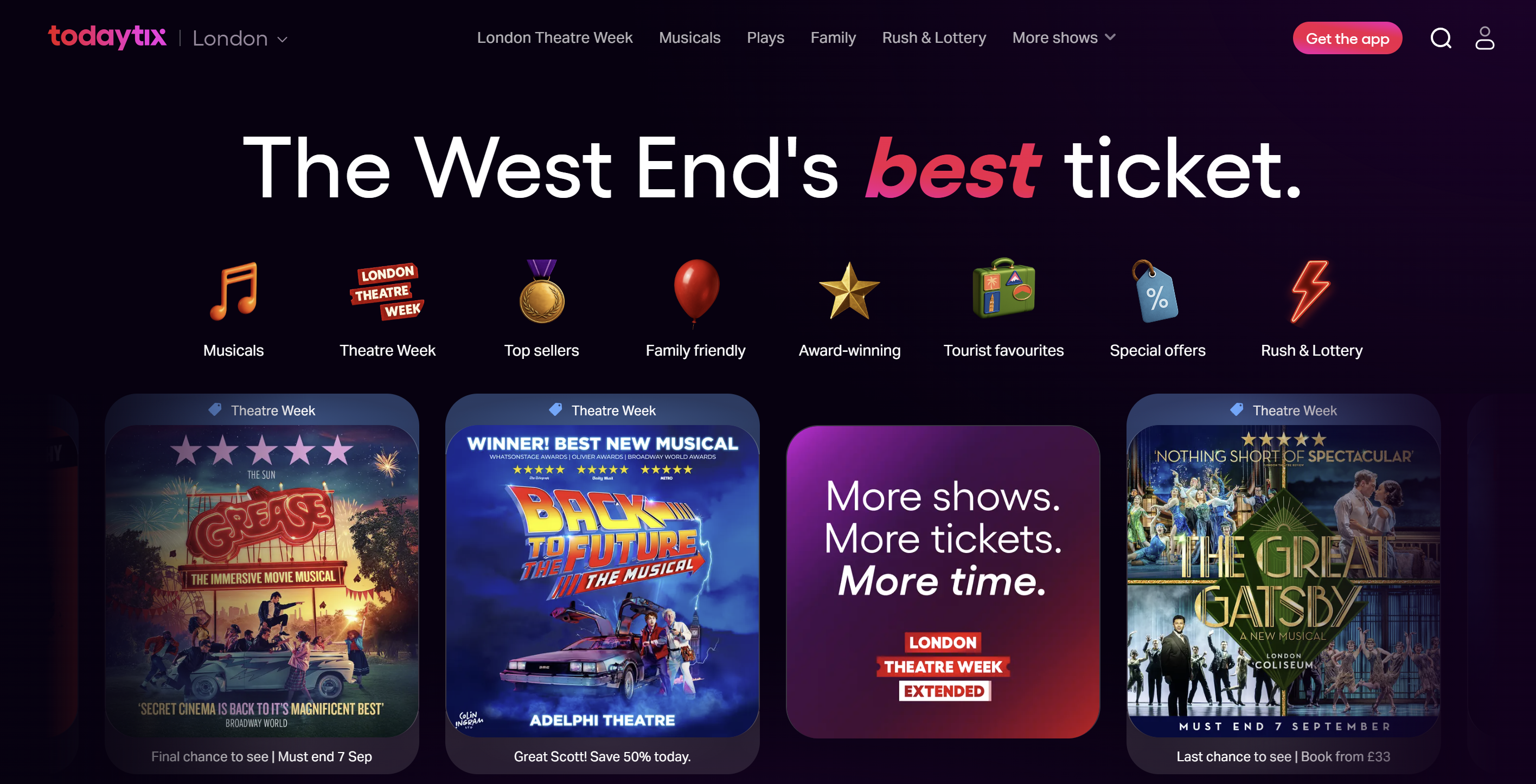

1. TodayTix

TodayTix is a theatre ticketing app founded by a Broadway producer, focusing on providing low-cost and convenient ticket purchasing experiences. It was founded in New York and has now expanded its service to over 15 cities around the world, including London, Chicago, Los Angeles, San Francisco, and Melbourne.

In the UK, it is mainly used to purchase tickets for live performances such as musicals, dramas, operas and dances in the West End of London. It is suitable for tourists who plan to watch plays but do not want to book tickets months in advance or pay the full price. It is also suitable for local audiences.

Key features:

- Large discount: The official often releases rush tickets, time-limited discount tickets, and even offers up to 80% discounts.

- Fast ticket purchase process: Seat selection, payment, and ticket issuance can all be completed within 30 seconds. Electronic tickets can be scanned directly for entry.

- Daily lottery: Users can participate in the lottery to have the chance to get free or discounted tickets for popular performances.

- Real-time information: Performance schedules, remaining tickets, and prices are updated in real time. It also provides performance introductions, stage photos, and reviews to help users make decisions.

- Membership system: After registration, points can be accumulated, which can be used to offset ticket prices or unlock more exclusive discounts.

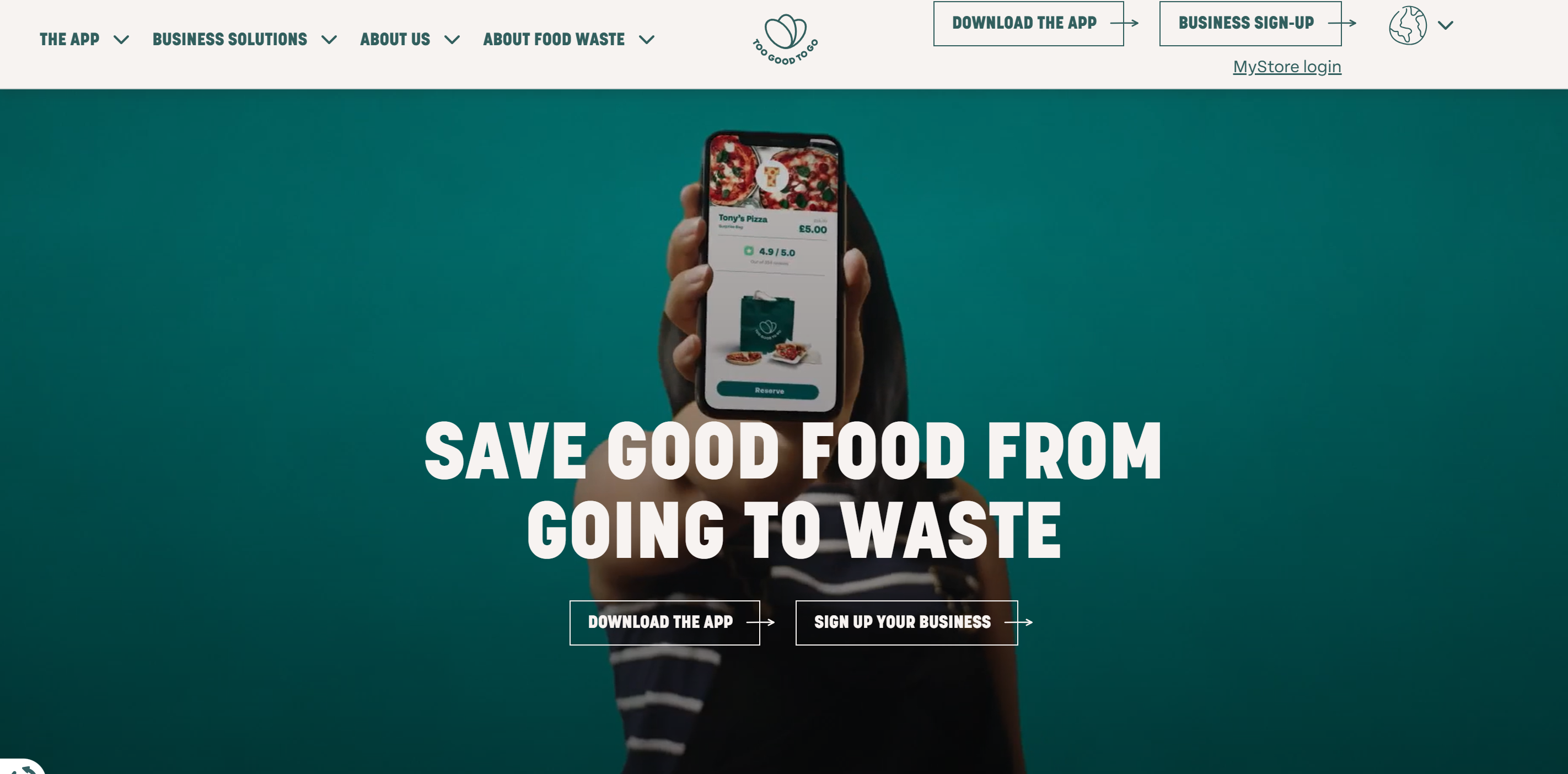

2. Too Good To Go

Too Good To Go is an “anti-food waste” app founded in Denmark in 2015. The UK is one of its most active markets. It transforms the unsold but still within their expiration dates food from restaurants, bakeries, supermarkets, cafes, hotels, etc. into magic boxes. Users can reserve them online at a price of 2 to 5 pounds and pick them up at the designated time.

This good app for saving money is suitable for students, office workers and tourists who want to save on food. The best time to secure the remaining meals for the day is between 7 and 9 p.m. It is recommended to add your frequently visited stores to the favourites and set reminders to avoid them running out.

Key features:

- Save money: Usually, spending only 1/3 to 1/2 of the original price can get a large bag of meals or ingredients.

- Environmentally friendly: Every time you take a box, the App will show in real time the reduction in CO₂ emissions caused by this purchase.

- Blind box experience: What is inside is determined by the remaining stock of the store at that day. You can only choose the type, such as bread, sushi, fruits and vegetables.

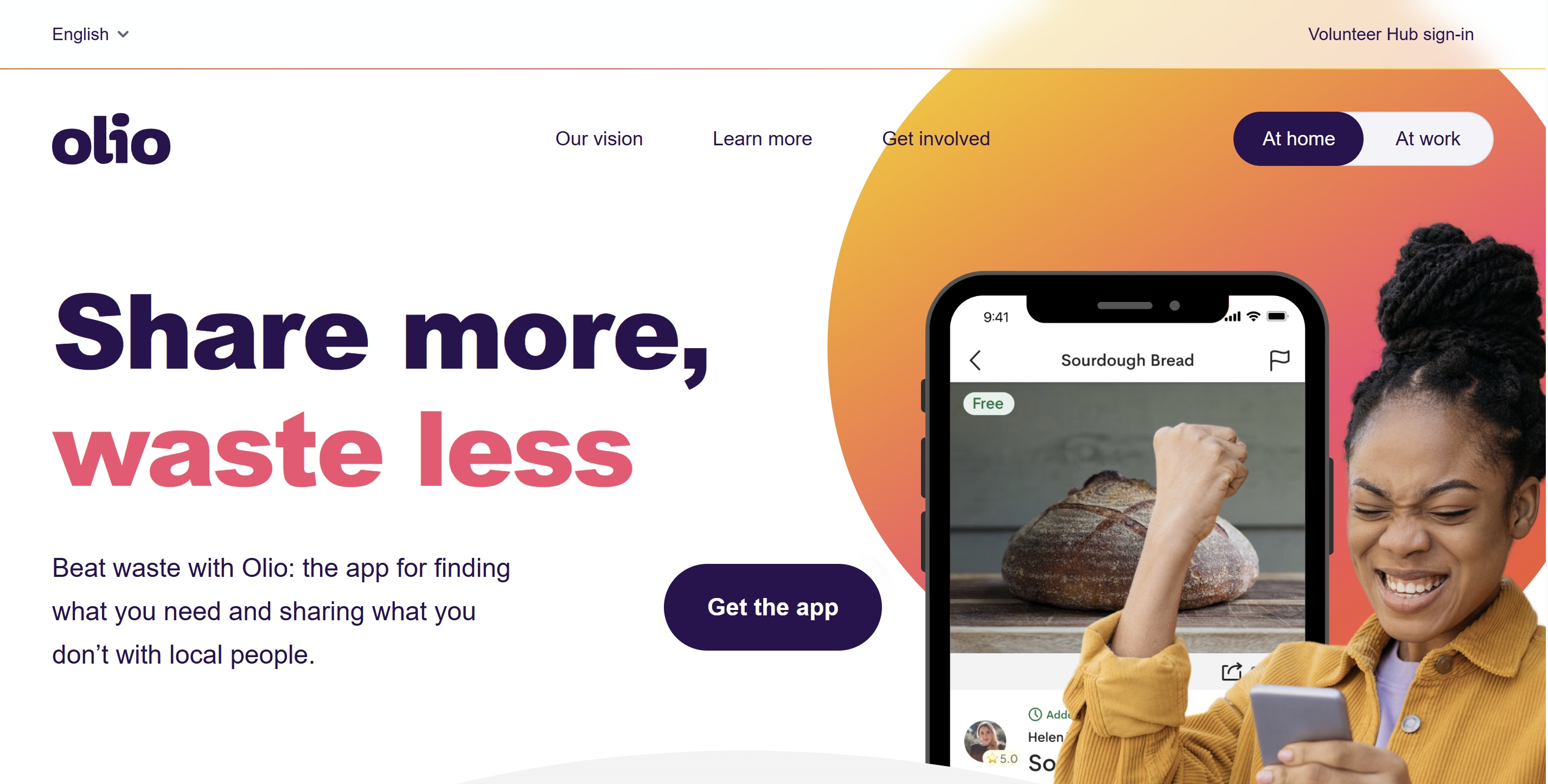

3. Olio

Olio is a sharing app headquartered in the UK, founded in 2015. It connects neighbours with local businesses to share food and daily necessities that are still usable but about to be discarded, all for free or at a low price. This way, it reduces waste, saves costs, and promotes community mutual assistance.

Key features:

- Food sharing: Users can take photos of the leftover ingredients and expired food in their homes and upload them. Within 2 hours, neighbours can apply and pick up the items themselves.

- Supermarket/Restaurant partnership: The platform recruits volunteers to regularly collect the unsold food from stores like Tesco and Sainsbury’s on the same day, and then distribute it to community residents through the App.

- Price reduction map: It displays real-time discount information of nearby stores, helping users plan “money-saving routes”.

- Community discussion: Users can discuss environmental protection topics to enhance neighbourhood interaction.

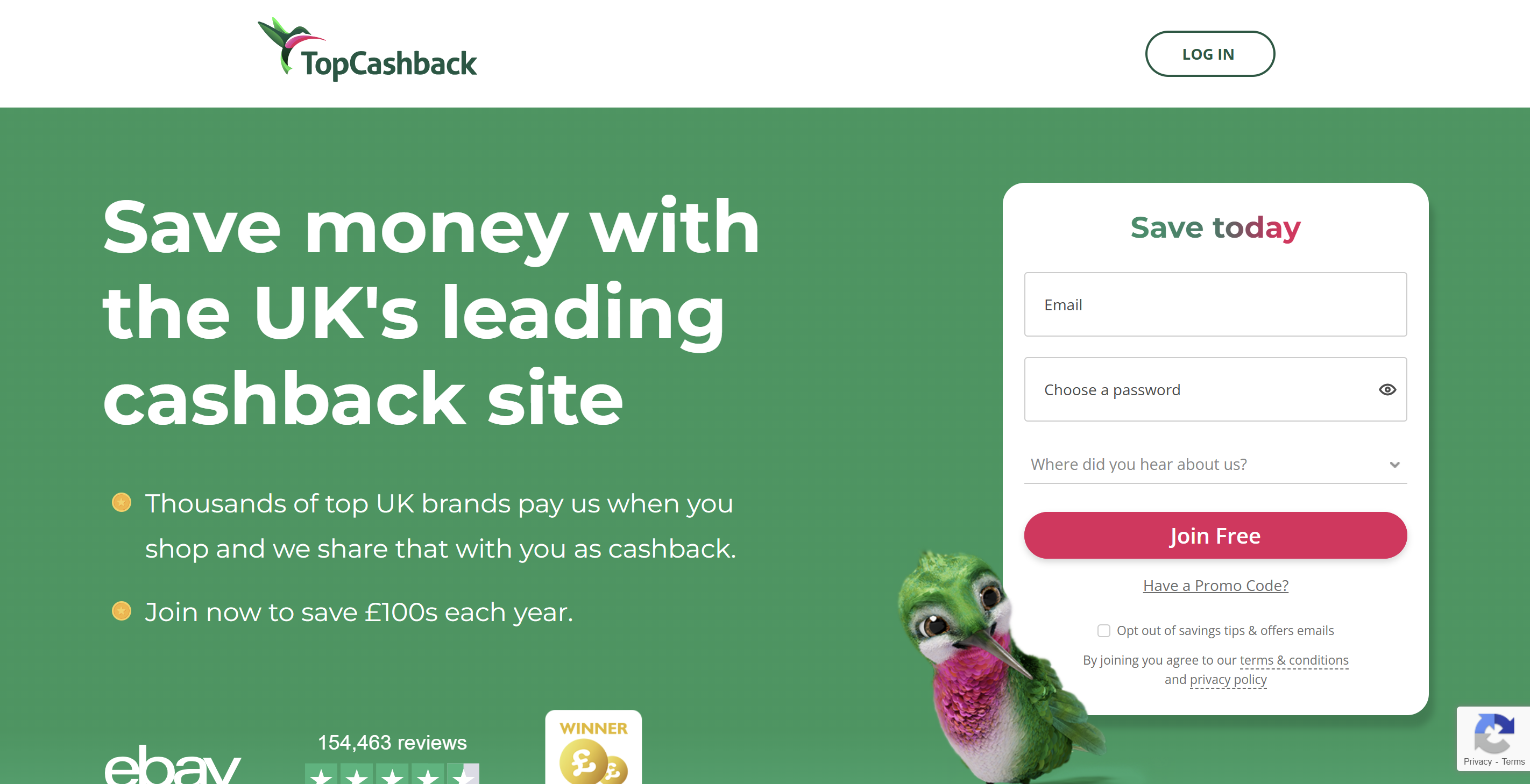

4. TopCashback

TopCashback is a UK shopping rebate app founded in 2005. Currently, it is the largest British rebate platform and one of the leading platforms globally, with over 6,000 partner merchants. For daily online shopping, food delivery, booking flights and hotels, as well as changing energy suppliers, as long as you click on the merchant link and place an order within the app, you can “earn while shopping”. On average, British students and permanent residents can save over £300 per year.

Key features:

- Shopping rebates: By using the app to directly navigate to e-commerce platforms such as Amazon, eBay, Tesco, Just Eat, etc. for placing orders, you can receive up to 17% cashback.

- High rebate guarantee: The official promises highest cashback guarantee. If you find that other platforms offer higher rebates, you can submit a claim.

- Diverse withdrawal options: Once the rebate reaches £0.01, you can withdraw it to your UK account or PayPal. You can also exchange it for gift cards of Amazon, Primark, etc. and enjoy additional rewards.

- Plus membership: UK users can pay £5 per year to upgrade to Plus, which offers additional rebates, exclusive discounts, and lottery opportunities.

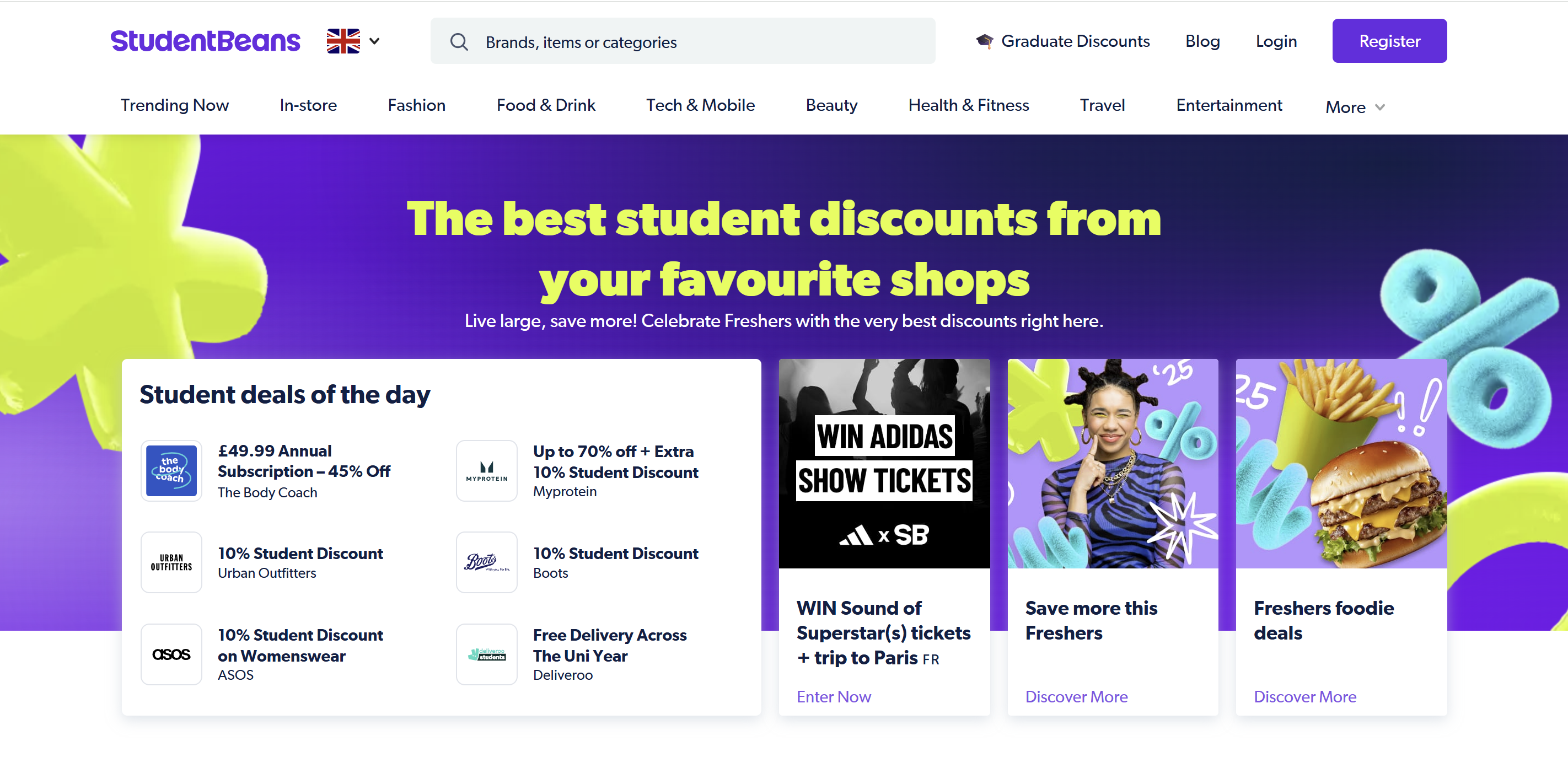

5. StudentBeans

StudentBeans is a student discount app launched in the UK in 2005, covering over 1,000 brands such as catering, transportation, and entertainment. It provides free discount codes and electronic student IDs specifically for current university students. Whether you are studying or traveling in the UK, as long as you are a student, StudentBeans is one of your best money saving apps.

Key features:

- Free registration: Verify your identity using your school email or student ID. No annual fee required.

- Convenient discount codes: Simply copy and paste the code to Amazon, Apple, ASOS, Superdrug, Domino’s and other websites for a 5-50% discount upon checkout.

- In-store scanning discounts: Show the StudentBeans ID in the app when checking out in-store, and enjoy the student price.

- Exclusive offers: Limited-time flash sales on the app, Wednesday lottery, follow the brand for new product alerts.

- Chrome extension: Install the extension, and it will pop up real-time reminders of available student discounts when browsing shopping websites.

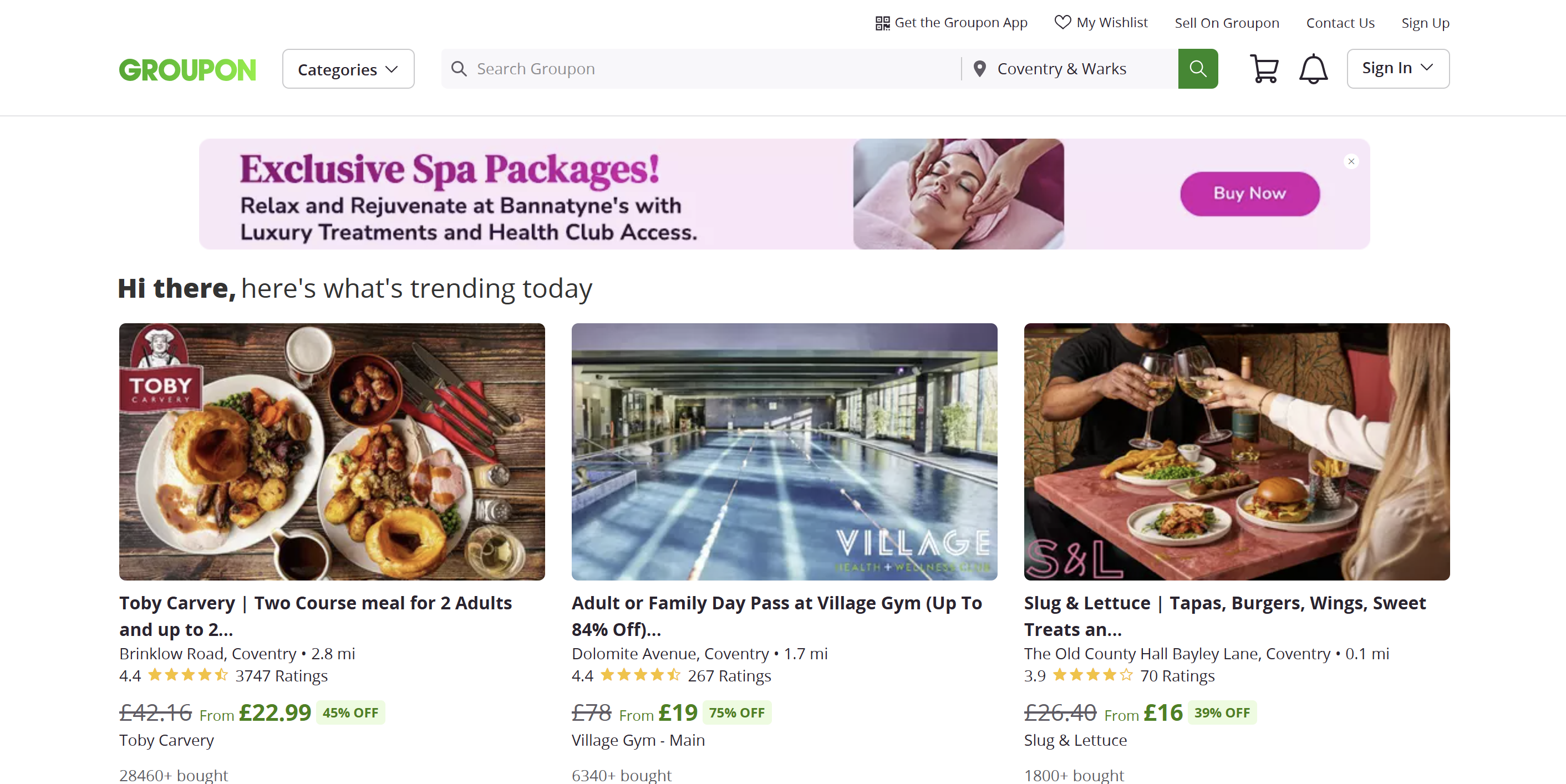

6. Groupon

As one of the best apps for saving money, Groupon is an app that focuses on group buying and local discounts. It was founded in the United States in 2008 and entered the UK in 2010. Now it has become one of the largest time-limited group buying platforms in England. If you want to save money and experience local life or take a short trip in the UK, you can open Groupon and search. There is a big chance that you can get group buying coupons at half price or even a 10% discount.

Key features:

- Direct purchase of goods: Necessities such as cosmetics and small household appliances, free shipping to your home, with comprehensive after-sales service.

- Recommended travel packages: Short-term trips to European cities, trips within the UK, etc. are very affordable, with prices lower than those on the official website.

- Limited-time flash sale: The app pushes “Doorbuster” flash sales every day, usually lasting 6-12 hours.

- Flexible refund: Unconsumed goods can be refunded at any time, and expired goods will be automatically refunded to your Groupon account, allowing for further consumption.

7. Plum

Plum is a personal finance app launched by the British company Plum Fintech Limited. It was founded in London in 2016 and currently serves over 2 million users in Europe. Throughout its history, it has always been one of the best money-saving apps in the UK. By linking Plum to your bank card, it can act as a 24/7 AI financial manager, helping you secretly save money and easily invest.

Key features:

- Automatic savings: After connecting to your British bank account, the app’s AI will automatically transfer savings that can be saved into the Plum account every day based on the income and expenditure patterns.

- High-interest savings: Offer “Interest Pockets” with floating interest rates up to 4-5% and 95-day notice accounts. These accounts are all covered by the UK FSCS.

- Convenient investments: Minimum investment of 1 pound. Choose from funds on technology giants, green energy, etc., or purchase US stocks (with no commission).

- Money-saving reminders: Automatically scan bills to find cheaper energy, broadband, and insurance plans, and can be switched with one click.

- Pension & lifetime ISA: Support Plum SIPP and Lifetime ISA. Enjoy additional government rewards for home-buying savings.

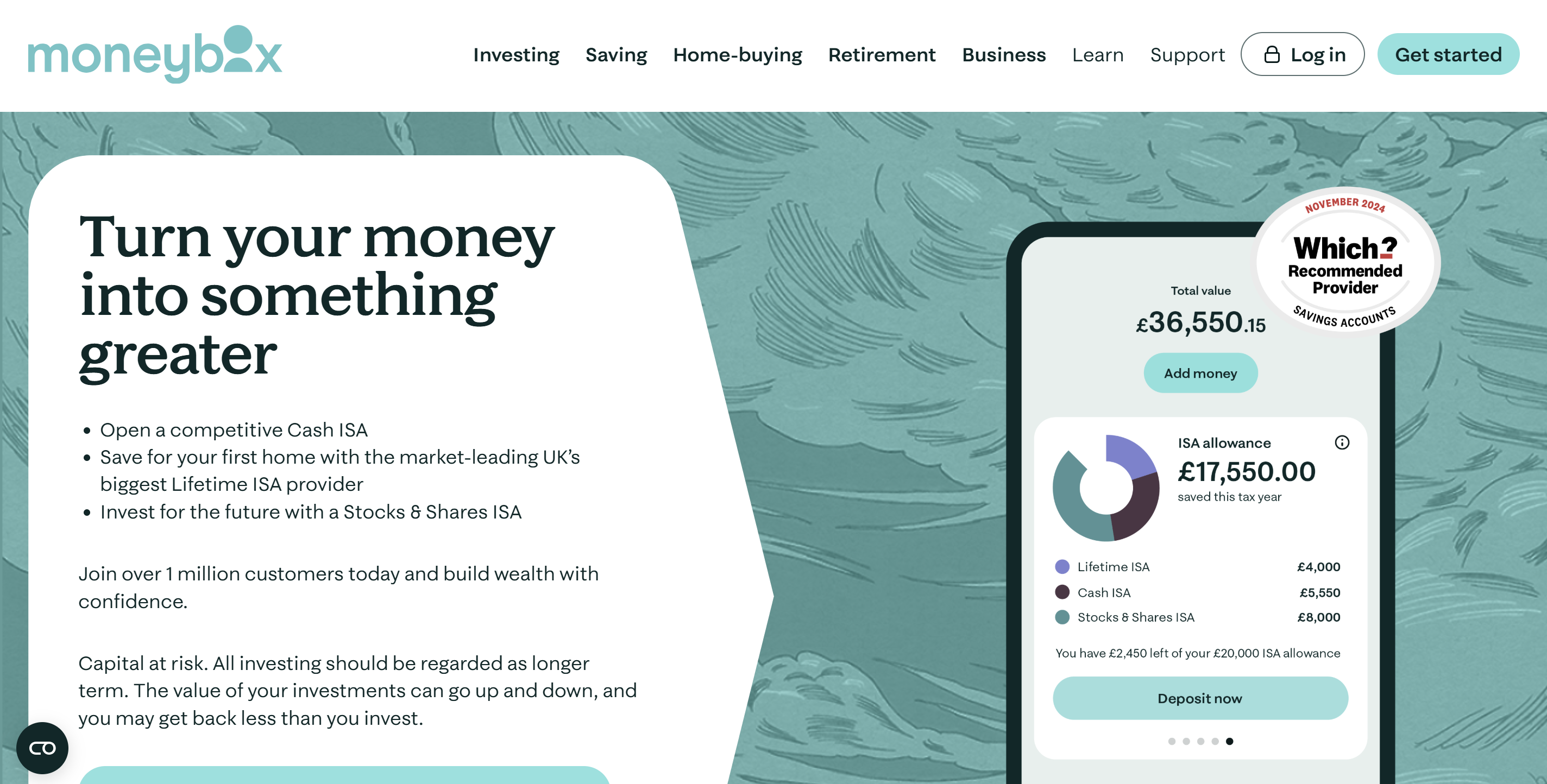

8. Moneybox

Moneybox is a local app in the UK, focusing on small savings and home purchase savings. It was founded in London in 2015 and currently serves over 700,000 customers, managing assets worth over 1 billion pounds. In the UK, as long as there is a balance change in your bank account, Moneybox can help you turn the small amounts into down payments or retirement funds. It can save your time, effort.

Key features:

- Low-cost investment: After binding your UK bank card, every purchase will be automatically “rounded up”, and the difference will be invested in stocks & stock ISA, life ISA or pension. The minimum investment can low to £1.

- Life ISA: You can save up to £4,000 per year, and the government will give a 25% bonus (up to £1,000).

- Savings account & Cash ISA: It offers savings plans with immediate access and cash ISAs with leading annual interest rates, both are protected by FSCS.

9. Chip

Chip is a good app for saving money in the UK, and is mainly responsible for automatic savings and investment. Founded in 2017, it has now been authorized by the Financial Conduct Authority (FCA) of the UK, managing assets exceeding 5 billion pounds and having over 400,000 users. All you need to do is connect your bank card to Chip, and it will transform into your personal AI financial manager. This is one of the best saving apps that can help you quietly turn the leftover money into high-interest savings or global index funds. It is convenient and legal.

Key features:

- Automatic savings: Connect to UK bank accounts via Open Banking, and AI automatically transfer spare money to the Chip Savings Account.

- High-interest accounts: All are covered by FSCS.

- Instant Access: 4.84% AER, available for immediate withdrawal

- Cash ISA: 4.70% AER, tax-free interest

- Prize Saver: Monthly grand prize of £50,000 can be drawn from the balance

- Low-entry investment: £1 minimum investment. Choose from over 40 thematic funds managed by BlackRock/Vanguard/Invesco, with a platform fee of 0.25% (ChipX members 0%).

- Flexible access: Most accounts are credited instantly and no penalty for cash withdrawal.

10. Monzo

Monzo is a digital bank that was founded in the UK in 2015. Currently, it serves over 13 million users. It operates merely through a mobile app and has no physical branches. It can be used on both iOS and Android. In the UK, whether you are a student, an office worker, or a backpacker, by installing Monzo on your phone, you are essentially having a high-quality and fee-free bank card that will help you manage your finances.

Key features:

- Online operation: Open an account entirely online. Cards can be activated within 24 hours. Physical cards will be sent within 2-3 days. Supports Apple Pay / Google Pay.

- Real-time finance: Immediate notification for each transaction, and automatic categorization and generation of weekly/monthly reports. You can set a budget limit within the app, and be immediately alerted if you exceed it.

- Savings pots: Automatically allocate small change or salary to different pots, with a maximum annual interest rate of 4.1%, and can be withdrawn at any time.

- Convenient overseas consumption: Non-pound area card swiping or online payment can avoid currency conversion fees.

- Social transfer: Generate the “Monzo.me” link to receive payments from friends.

How do apps to save money work?

1. Bank account linked up

When you first open the money saving apps, the system will guide you to complete the registration using your mobile phone number, Apple ID, etc. Then, you can connect your bank accounts to the app. The underlying connection here is to the open interfaces of the bank or third-party payment institutions. All sensitive information is transmitted through encrypted channels and is subject to official supervision. After authorization is completed, the app can then read your income and expenditure records in real time, providing data for the subsequent automatic savings.

2. Saving money rules

After the authorization, the apps to help save money will run in the background according to the saving rules. It transforms various consumption scenarios in daily life into selectable rules. Once a transaction that meets the conditions is matched, an instruction will be immediately generated and entered into the task queue. If you are worried about excessive deductions, you can set a daily limit in the app, allowing the system to dynamically adjust the deduction amount based on your income and expenditure curve.

3. Value-added services

Once the money is deposited, if it just remains in the current account, it will soon be affected by inflation. But if you choose these best money saving apps, they will automatically link your balance to money market funds, short-term bond funds or intelligent investment portfolios. To encourage long-term holding, some apps also set up tiered interest rates, meaning the higher the balance and the longer the holding period, the higher the yield.

4. Risk control system

In the background, these best apps for saving money UK are running a complete set of risk control systems, including device fingerprints, IP anomalies, large-scale rapid deposits and withdrawals, etc. All of these will trigger the risk control model. And in necessary cases, the deductions will be suspended or facial verification will be required. To prevent accidental operations, the platform sets an upper limit on the single transaction and daily deduction amounts.

Pros and cons of using saving money apps

Installing best saving apps on your mobile phone seems to have become the first step for people to manage their finances in the modern era. So, are these apps financial tools or digital traps? Below, we will briefly introduce their advantages and disadvantages.

Pros

- Automatic savings to reduce the risk of excessive consumption: The app can use algorithms or the round-up mechanism to automatically transfer spare money or surplus funds to savings or investment accounts.

- Expenditure visualization: Present the consumption structure in a graphical form, allowing users to clearly see the spending in categories such as dining, subscriptions, transportation, etc., making it convenient to adjust the budget in a timely manner.

- Goal setting and reminders to enhance the motivation for savings: Users can set their own goals such as travel fund or emergency fund. The app will indicate the gap from the target amount and encourage continuous investment.

- Reducing the burden of manual keeping accounts: After synchronizing bank cards and credit cards, it automatically retrieves and classifies transaction records, eliminating the need for manual input.

Cons

- Security and regulatory issues: Some apps to save money are not official, and the funds may not be fully insured by deposit insurance.

- Low interest rates, limited returns: The interest rates of the savings accounts are significantly lower than those of high-interest savings accounts or term deposits, which may lead to waste over the long term.

- Technical failures or data leakage risks: Server outages, program bugs, or hacker intrusions can result in account information leakage or temporary inability to withdraw funds.

- Some functions require payment for use: Advanced functions (such as automatic investment, bill payment) often require a monthly fee.

How to choose best apps for saving money UK

1. Identify the core requirements

In the UK, the selling points of money saving apps vary greatly. For instance, Chip or Plum focus on automatic savings. Monzo’s savings pot is like a virtual piggy bank, suitable for small daily deposits and withdrawals. By clearly determining whether you prefer to save money or manage finances, you can more quickly identify the best saving apps that are suitable for you.

2. Check if your bank account is compatible

Since 2018, the UK has fully implemented Open Banking. According to this policy, all banks regulated by the FCA are required to open their APIs. If the best money saving apps you use are relatively niche, it’s best to first check supported banks in the app and confirm that your bank account is listed.

3. Compare the cost structure of the app

In the UK, the business models of saving money apps can be broadly categorized into three types: completely free, free with premium subscription, and pure subscription model. You can compare the pricing systems of these apps and, based on your personal needs, choose the most cost-effective good app for saving money.

4. The app's usability and customer service

Although the ratings on the App Store and Google Play cannot be entirely trusted, they can still serve as a reference. After registration, you might as well simulate a few transactions first to observe whether the account synchronization is real-time and whether the push notifications are too frequent. Then, you can decide whether to keep the account for a long term.

Conclusion

In summary, when choosing the best money saving apps, the key is to clearly understand your own needs. Once you have chosen the right tool, treat it as your personal financial assistant. It will allow you to know at any time how much money is left in your pocket. More importantly, when you start making decisions based on data rather than feelings, your anxiety about money will significantly decrease, and you will have a greater sense of control over your life. Persistence is crucial. Even if you occasionally overspend, don’t blame yourself. Just make up for the shortfall gradually in the following days. I wish you could use these best money saving apps soon and lead a relaxed yet confident life.

FAQ

Money saving apps are worth using, but you should choose them carefully.

It can automatically record transactions, remind you of discounts, track your budget and help you identify areas where you can save money. However, if it requires a subscription fee or induces you to buy unnecessary discounted items, it will actually waste your money.

Therefore, it is recommended to start with the free version, set clear goals, and conduct regular reviews. Don’t let the app replace your self-control.

The mainstream round-up apps in the UK are:

- Moneybox

- Monzo

- Plum

- Starling Bank

These apps are all regulated by the FCA in the UK and are covered by £85,000 FSCS insurance. You can choose the fees and interest rates.

In the UK financial community, the “50/30/20” rule is commonly used. It means that at least 20% of your after-tax income should be allocated for savings and investments. For example, if your monthly income is £2,500, you should save £500. If your income is low, you can start by saving 10% of your after-tax income and gradually increase the amount.

Yes.

The mainstream best apps for saving money UK, such as Plum, Moneybox, Monzo, Chip, etc., are all regulated by the Financial Conduct Authority (FCA) of the UK and are included in the authorized list of openbanking.org.uk. This means they must comply with strict security and data protection regulations, and some even enjoy the highest FSCS coverage of 85,000 pounds.

As long as it is a legitimate app, it is very safe.

All legitimate money-saving apps in the UK are regulated by the Financial Conduct Authority (FCA) of the UK and are listed on the website openbanking.org.uk. It means they must comply with security and data protection regulations, and some accounts enjoy deposit protection under the FSCS. Before using, you can check their registration numbers at the FCA website or at the bottom of the app’s website to confirm they are regulated, and then bind your bank card after confirming the safety. This will result in a higher overall level of security.